The Invoices for which you want to claim ITC those invoices are known as unclaimed invoices.

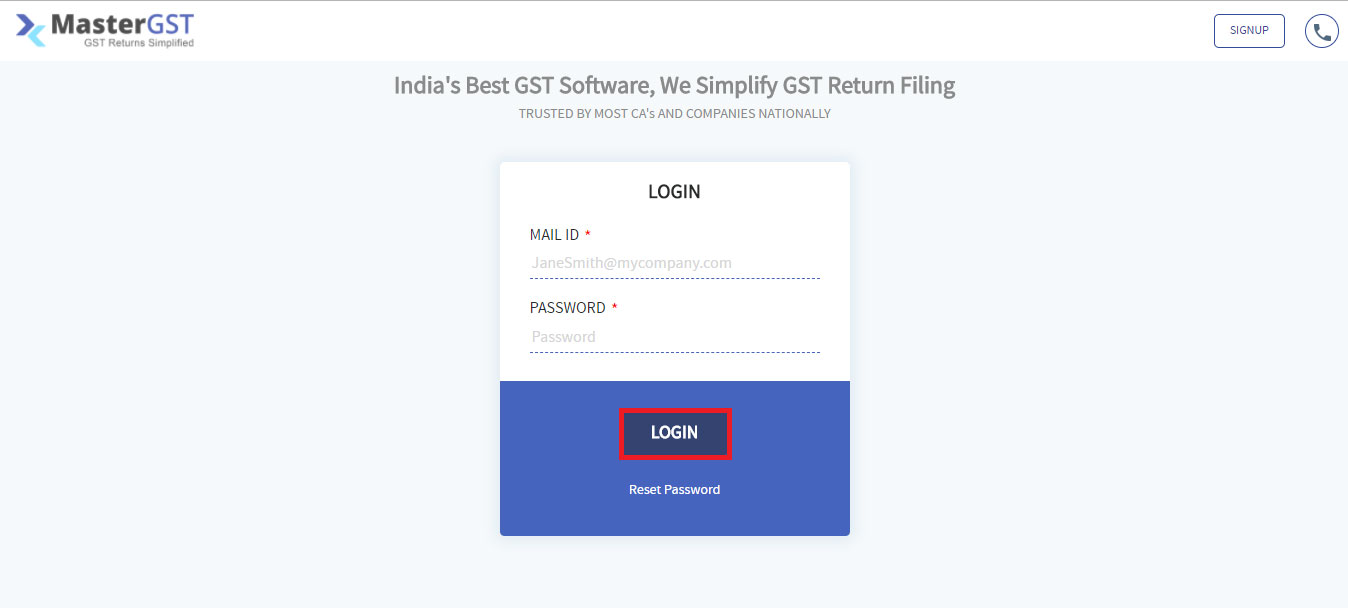

Step1 :

Login into MasterGST using same email and password as you registered.

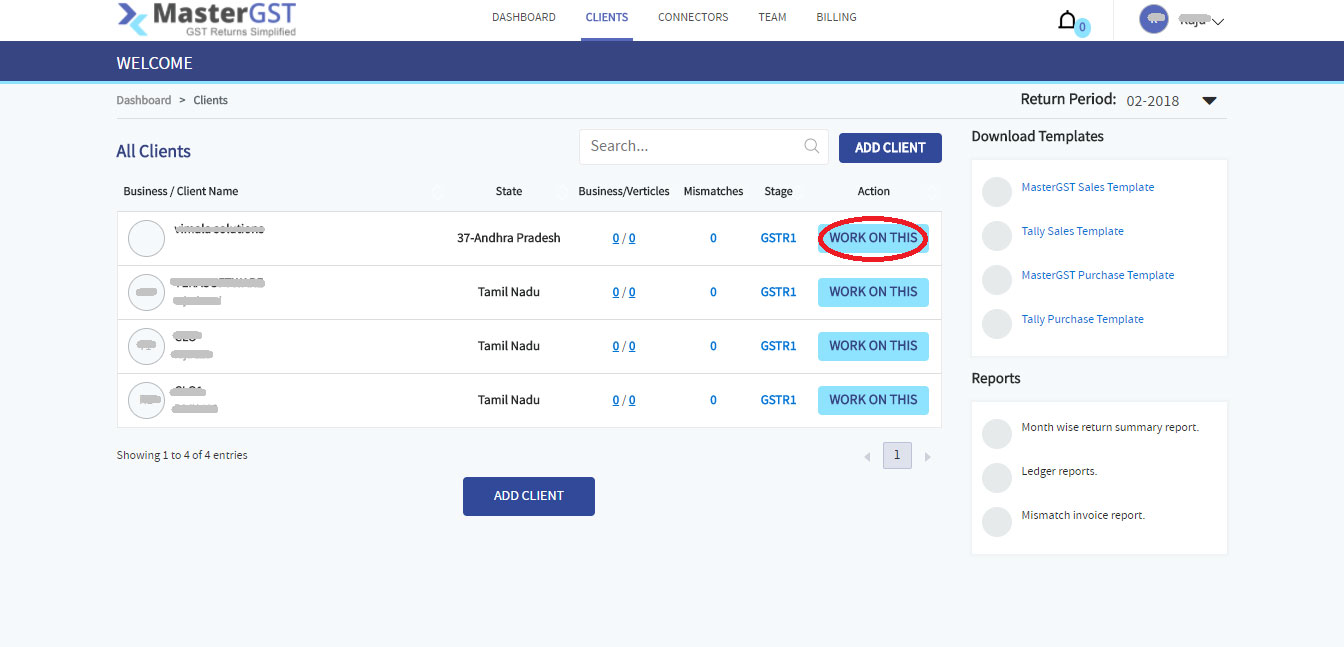

Step2 :

After Login Click On clients in menu , you will the get clients page. Select for which client you want to claim ITC by using WORK ON THIS button.

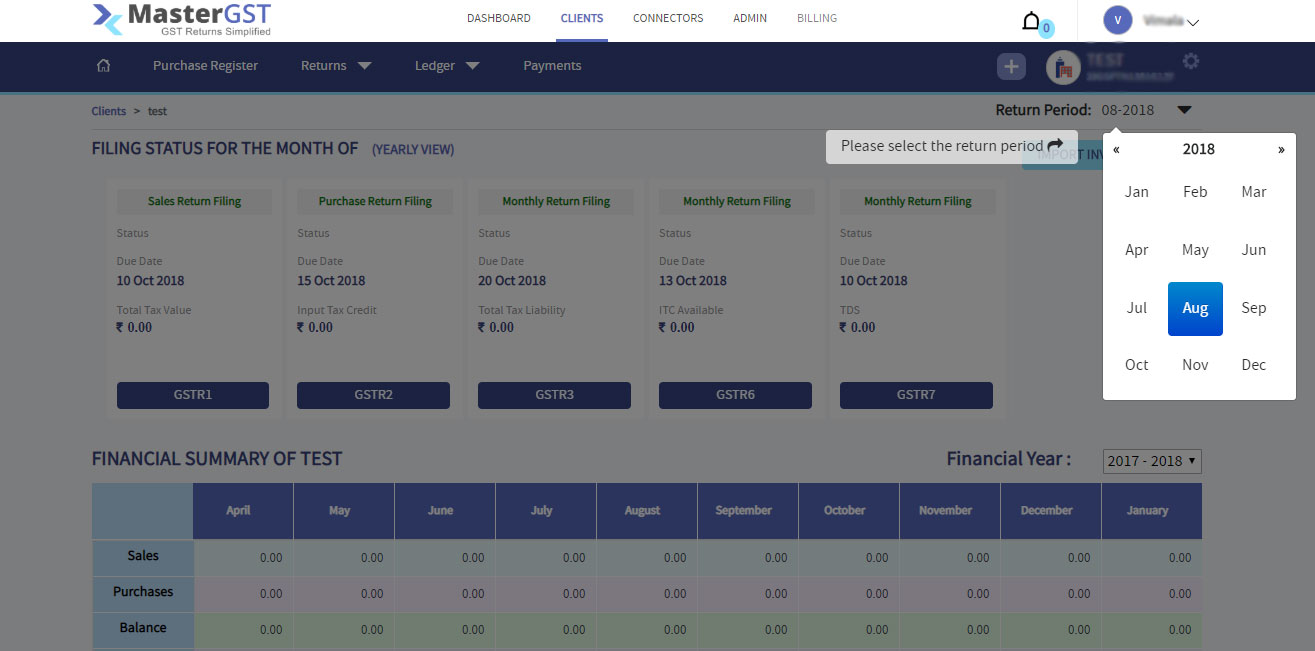

Step3 :

You will get a pop up calendar, Select for which month you want to claim ITC.

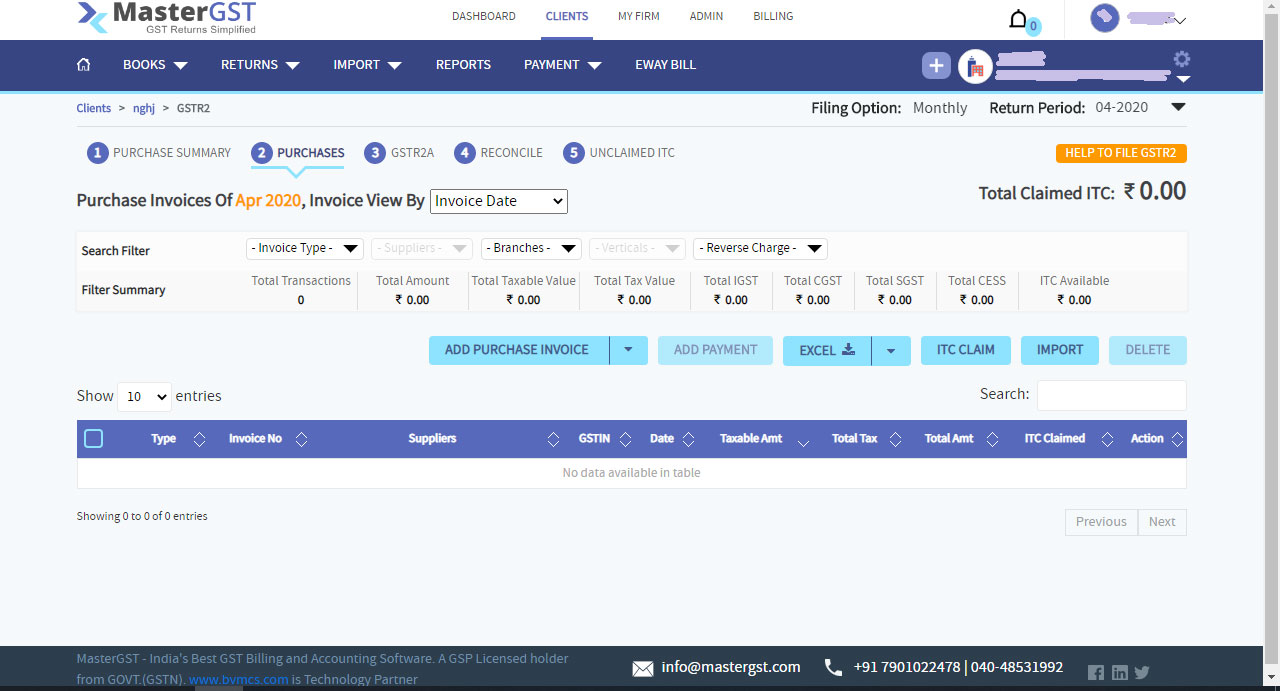

Step4:

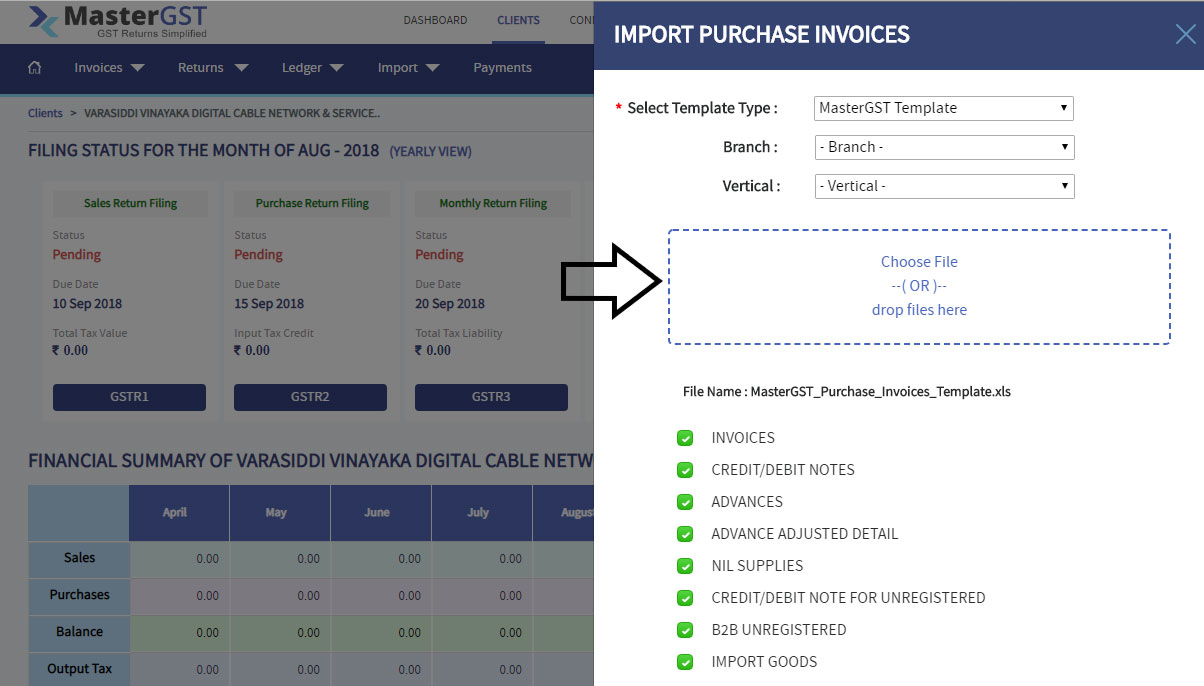

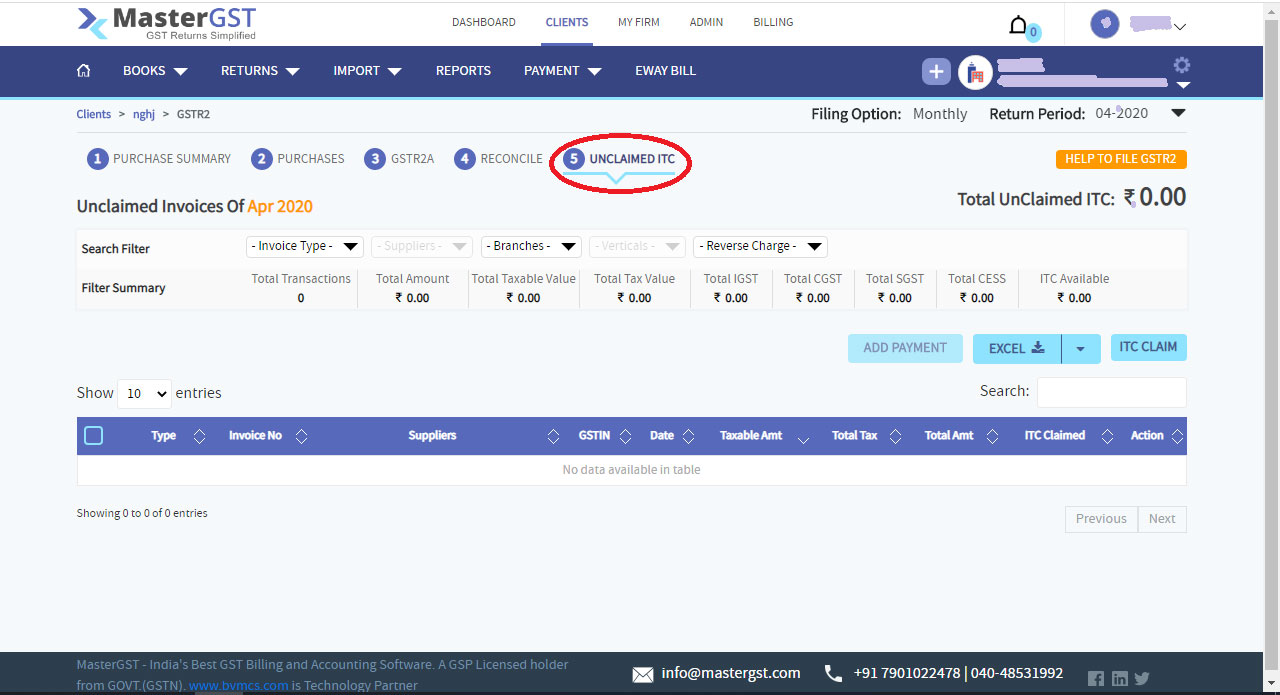

Click on returns in navigation menu, in that Dropdown select GSTR2. You will get a page with tabs, In that go to purchases tab. This unclaimed ITC is only possible when you have not selected any ITC type. In add invoice you can not save the invoice without selecting the invoice type. so it only possible when you import invoices through import option.

Step5 :

In that MasterGST Purchase template fill all the values except ITC type and eligible percentage. After importing this template this invoice will be under unclaimed ITC tab.

Step6 :

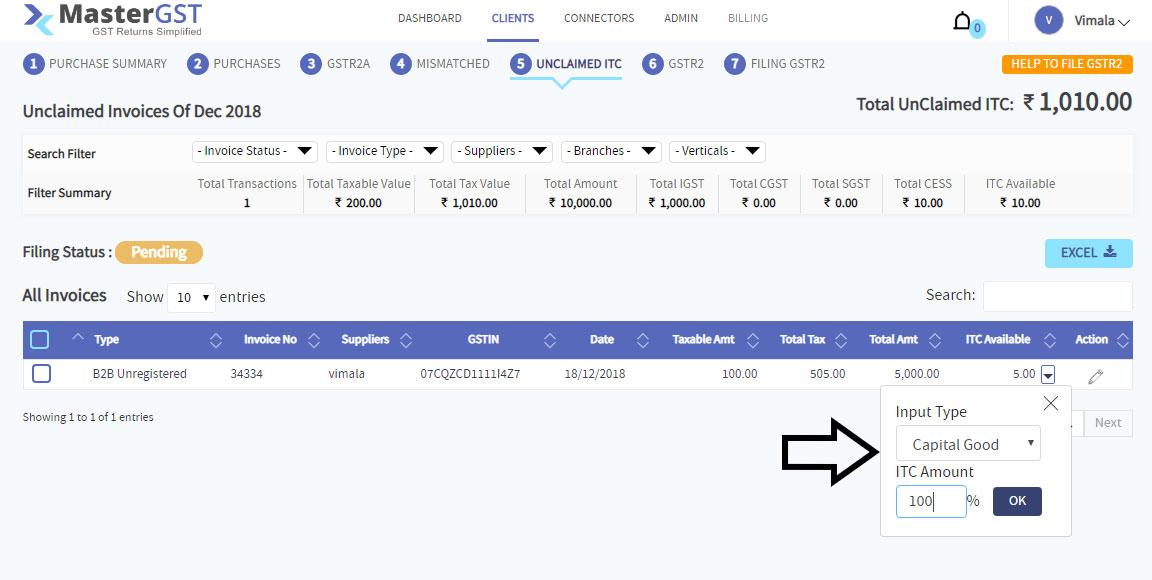

In that unclaimed ITC tab click on dropdown in ITC available column .

Step7 :

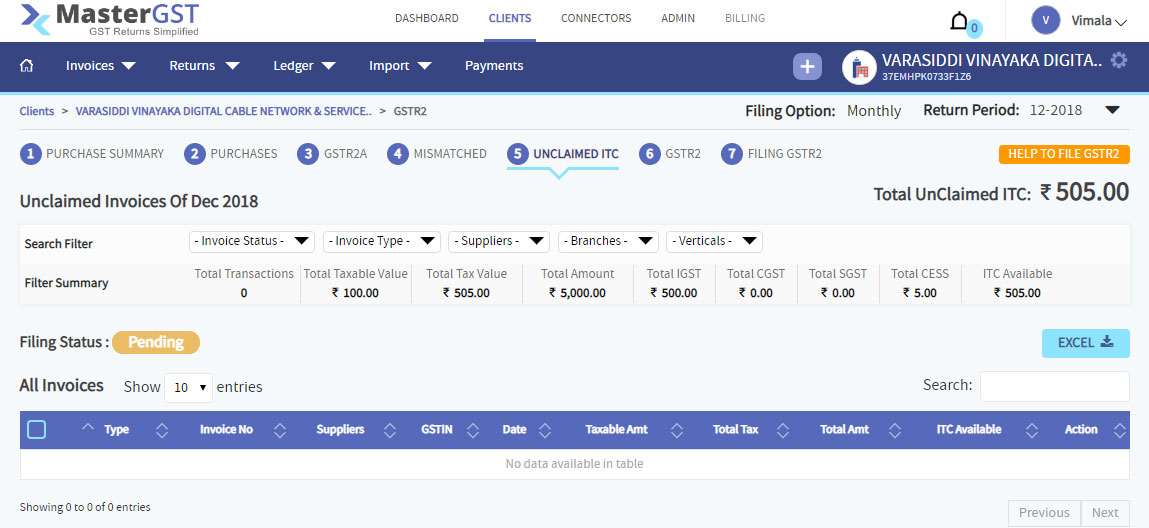

Select the Input Type and enter ITC Amount (percentage) and click on ok. After clicking on ok , you can’t see the invoice in unclaimed ITC tab (if the invoice still in the same tab please refresh page.).

Step8 :

After the you can see the same invoice in purchases tab.