when we submit our invoices to government and if we want to change the values in that invoice then that is known as amendments.

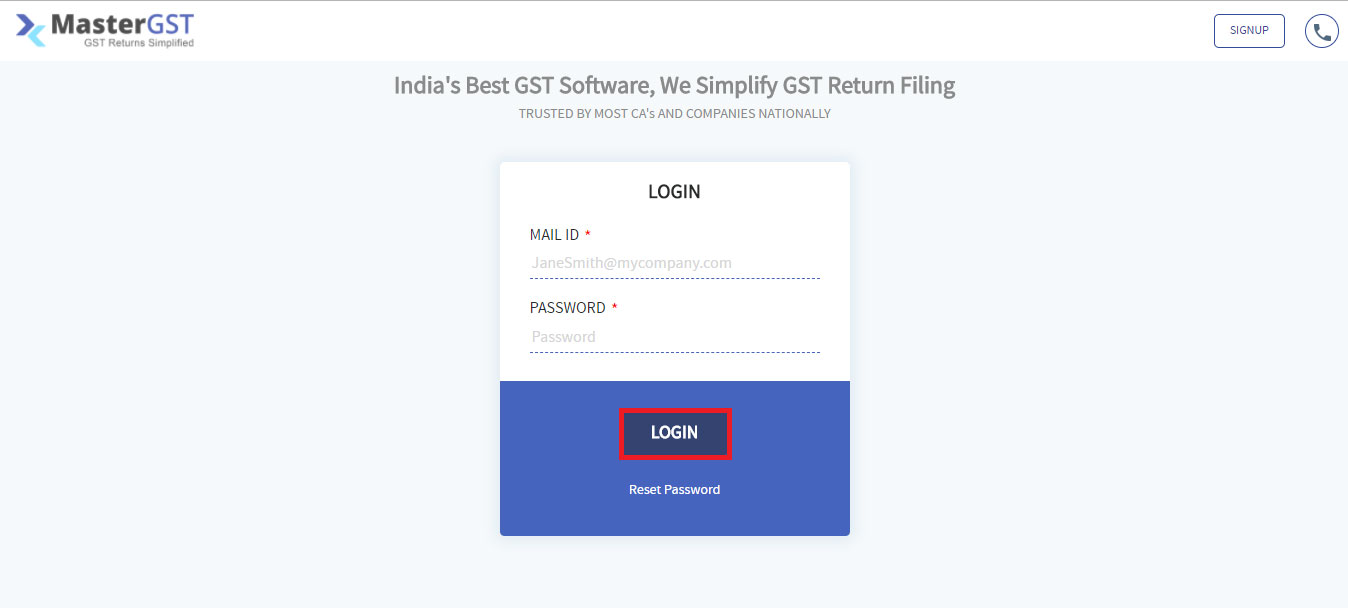

Step1 :

Login into MasterGST using same email and password as you registered.

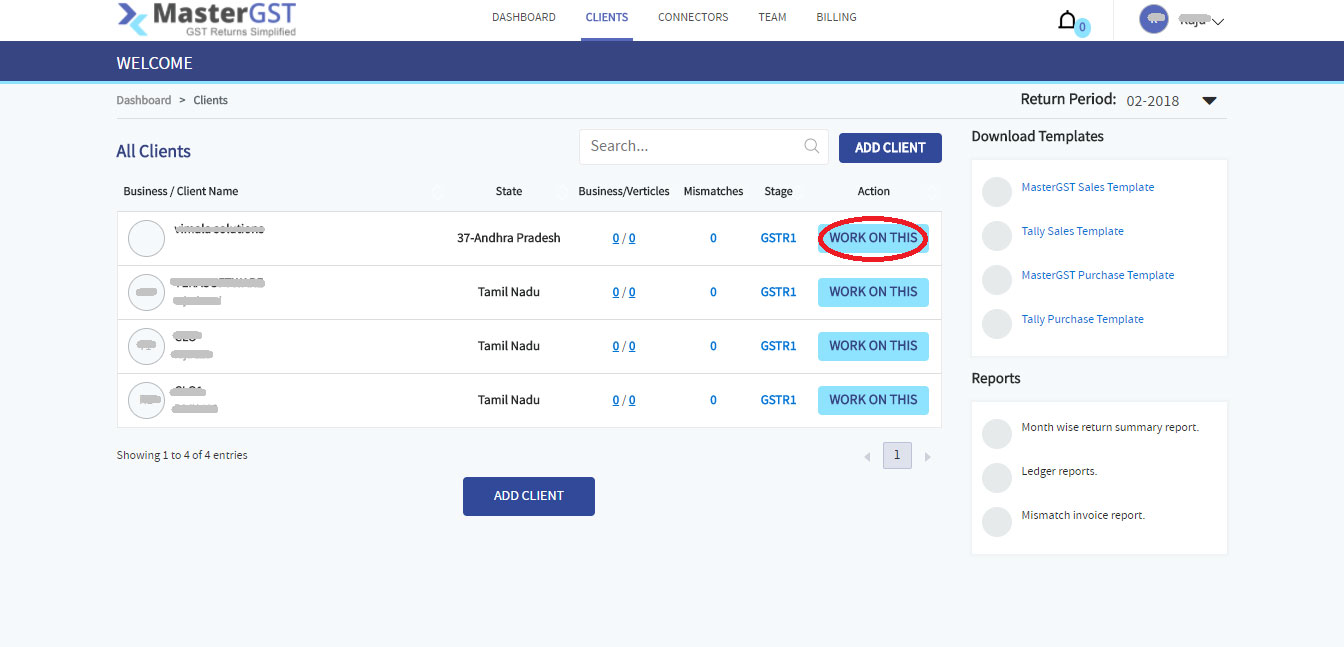

Step2 :

After Login Click On clients in menu , you will the get clients page. Select for which client you want edit Invoice by using Work on this button.

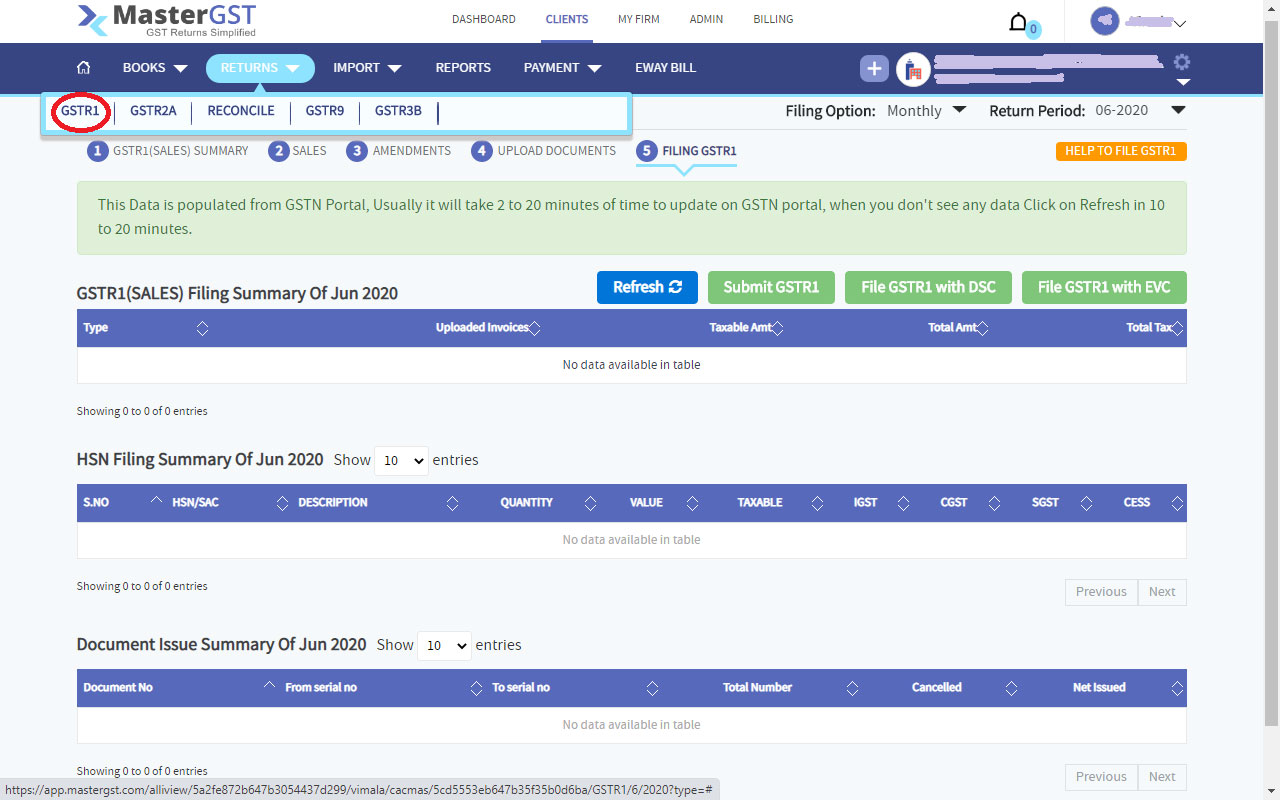

Step3 :

You will get a pop up calendar, Select for which month you want to edit invoice. Click on returns in navigation menu, in that dropdown select GSTR1.

Step4 :

You will get a page with tabs, in that go to Amendments tab.

Step5 :

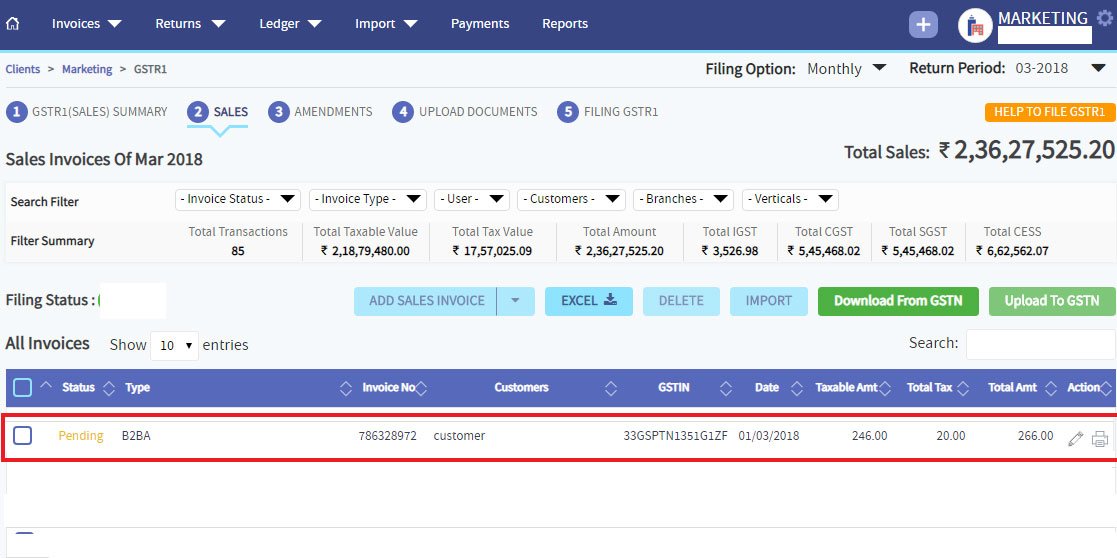

This data is came from GSTIN server, so click on “Download from GSTIN” button. You will get all the Invoices in that selected month. Now go to sales tab and select the filed invoice you want to edit.

Step6 :

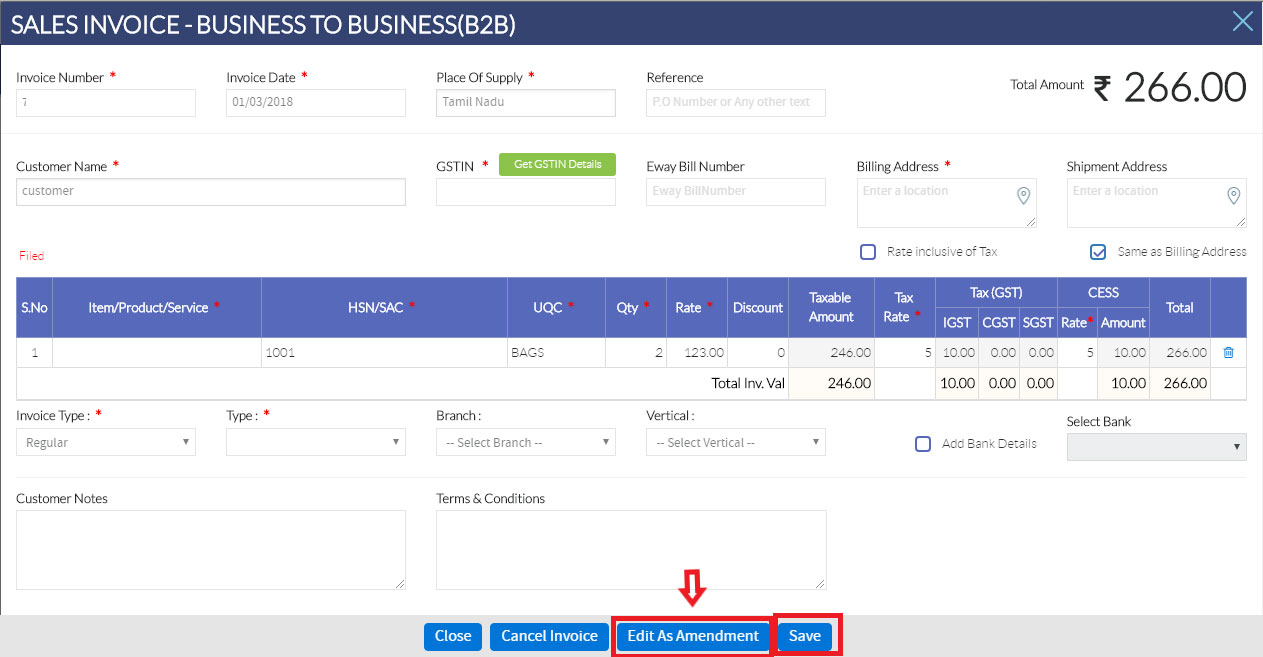

Click on edit button in action column(Last column). you will get a pop up. In that pop up you will get edit as amendments button click on it and edit the details and click on save.

Step7 :

After editing the filed invoice you will get filing status as pending and the file type will get A as extension.