A GST taxpayer who wants to generate, cancel or manage an e-Way bill can log in through www.ewaybill.gov.in or www.ewaybill.nic to the portal. ewaybillgst.gov.in is an official government portal used by the taxpayer or transporter to generate, cancel or manage e-way bill online login.

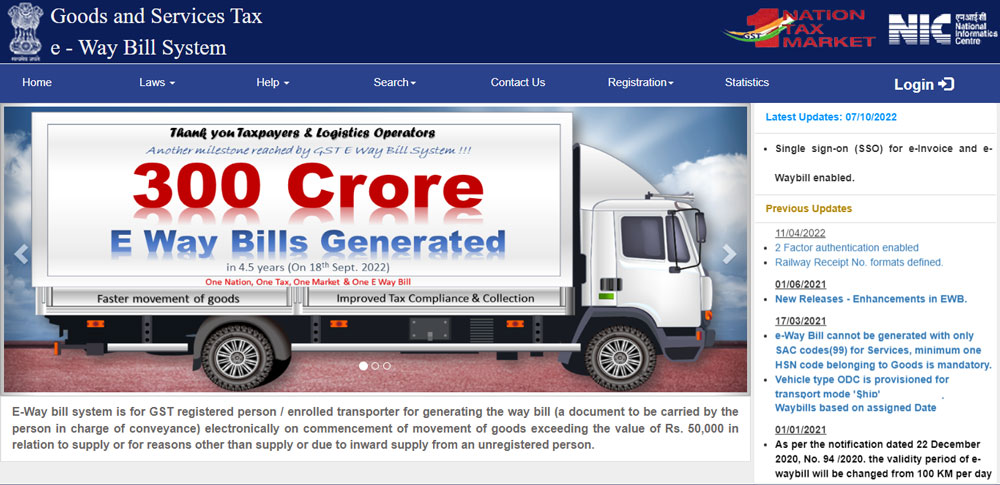

Home Page: e Way Bill Portal

Now let us check what the e-Way Bill Portal Login homepage looks like and which all tabs the portal contains. The bellow screenshot shows the www.ewaybill.nic.in portal homepage and all its tabs.

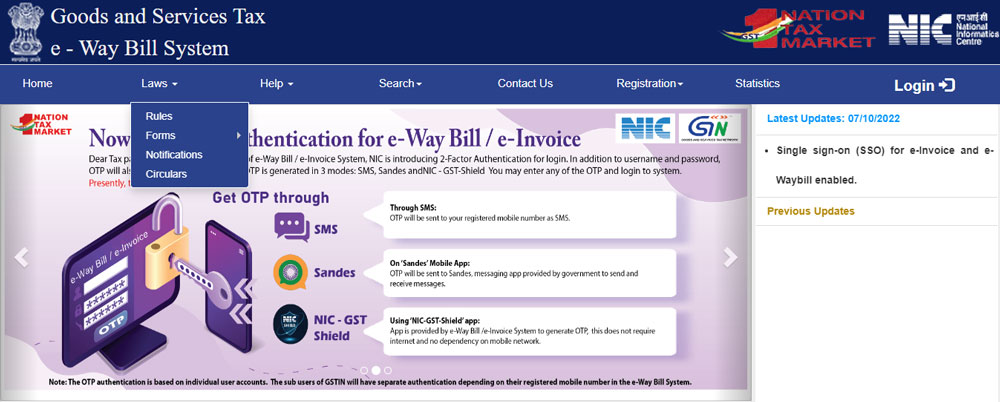

1. Laws

The taxpayer may check the rules, forms, notifications, and circulars issued under the GST laws through the e-way bill system login. By clicking on Rules, the taxpayer can easily refer to different rules state-wise. Similarly, the taxpayer or transporter can see sample formats of the Eway bill form using the Form button. The forms included under these tabs are EWB-01, EWB-02, EWB-03, EWB-04, ENR-01, and INV-01. In the Notification and Circular option, the taxpayer or transporter can find the latest notifications and circulars that the government issues regarding the e-way bill.

2. Help

Under the Help menu of the e Way Bill login page, the GST taxpayer can find different options such as User Manual, FAQs, Advertisement, and Tools.

The GST taxpayer, transporter, or any other person can check out the user manual for using the e-way bill portal. It can check the latest news or information related to the e-way bill using FAQs or CBT (Videos) under the user manual section.

Moreover, through the tools option, the taxpayer can find the templates related to the bulk generation facility available on the e-way bill portal.

3. Search

Under the Search menu at the e-way bill login on the mobile page, which is the e-Way bill login system, the person can search about the following things:

- Taxpayers by using their GSTIN

- Transporters through transporter ID or GSTIN

- Products and services with HSN Codes or names

- The distance between the two PIN codes

4. Contact Us

Here on this menu of the e-way bill login page, the taxpayer can find the region-wise contact details of the helpdesk.

5. Registration

Under the Registration menu, a new taxpayer, transporter, or any other person who needs to generate an e-Way bill can register through the e-way bill portal. Different headings under the registration menu:

E-way bill registration a regular taxpayer needs a GST Identification Number (GSTIN) and a registered mobile number to enroll on the e Way bill login system.

Enrolment for transporters A transporter can register himself on the e-way bill portal by clicking on the enrolment for transporter link. After successfully registering on the portal, the transporter will receive the transporter ID, which will help them log into the e-way bill portal.

Suppose any citizen who is not a taxpayer wants to generate an e-Way bill. In that case, he has to click on this link and can directly generate an e-way bill without logging into the e-way bill portal.

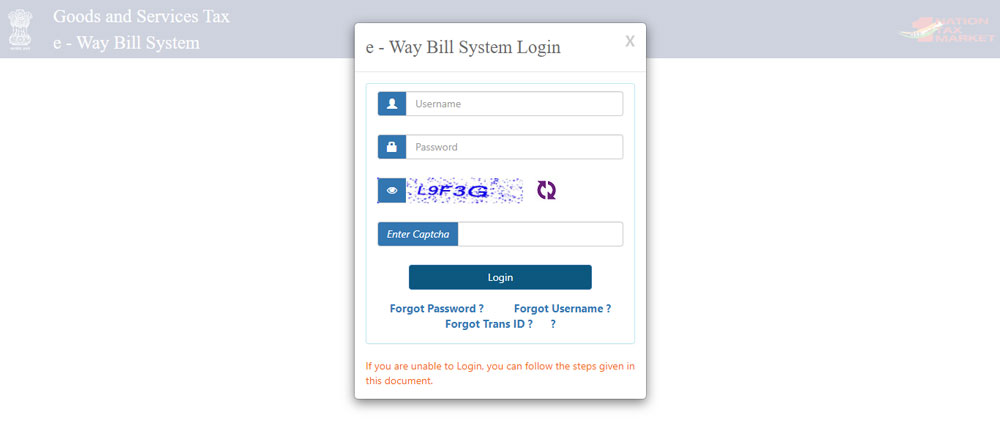

6. Login

This tab helps the taxpayer to log into the e-way bill portal, but the taxpayer must have a valid credential that includes:

- Username: The E-way bill portal login username must be at least 8 characters long and not more than 15 characters long. Furthermore, the login ID is a combination of alphabets (A to Z), special characters (@, #, $,%, &, *,), and numerals (0-9).

- Passwords for the e-way bill portal must be at least 8 characters long.

- Captcha After entering the username and password, the taxpayer must enter the code given in the captcha image to verify their e-way bill portal login. In case a taxpayer forgets his login credentials. He can click on Forgot Password/Forgot User ID or Forgot Transporter ID.

What is an e-way bill?

An e-Way bill is a document issued by the individual causing the motion of goods, whether a supplier of goods, a transporter or the recipient of goods, and giving details or instructions relating to the consignment of goods. It includes the names of the consignor and consignee, the point of origin of the consignment, the place of supply, and the route from which goods are moving.

What is the E-Way Bill Portal?

The e-way bill portal is one of the compliance mechanisms under GST laws wherein, by way of a digital interface, any person causing the movement of goods uploads the relevant details or information of a shipment of goods before the commencement of movement of goods and generates an e-way bill on the GST portal. In simple words, an e-way bill is an electronic document that can be generated through the e-Way Bill portal, which is the evidence for the movement of goods. The e-waybill (EWB) portal provides a simple and user-friendly gateway to generate e-Way bills (single or consolidated e-Way bills).

You can generate e-Way bills on Form GST EWB-01 in either of the methods.

- Through the online E-way bill portal

- via SMS or

- Using electronic invoicing

Prerequisites for generating an e-way bill on the E-Way Bill Portal for any method of generation are as follows:

- The registered taxpayer must use the E-way bill login ID and password with the GST invoice or any challan.

- If the transportation is by road, you must take the transporter ID or the vehicle number.

- Suppose the transportation is by rail, air, or ship. In that case, the transporter ID, transport document number, and date of these documents should be on hand.

How to register on the GST E-Way Bill (EWB) portal

- The user must have a GSTIN and a mobile number registered with the GST system.

- The user needs to enter the URL address of the E-Way Bill System in his browser.

- The user can register by clicking on the ‘e-way bill Registration’ link under the registration option. Then the GST taxpayer will be redirected to the ‘e-Way Bill Registration Form.

- The new user must enter their GSTIN number and code/captcha below and click on the ‘Go’ button to submit the request. Once the request is submitted, it will redirect the user to the following page.

- In the above form, the new user needs to mention their name in the Applicant name tab, firm/company name in the Trade name tab, the full address of the registered office under the Address tab, their mail ID under the Mail ID tab, and their mobile number under the Mobile Number tab.

- After filling in all the required fields, the user needs to click on the “Send OTP’ button to get an OTP for authorization of this registration process. The OTP will be sent to the registered mobile number of the user. Once the OTP is received on the registered mobile number, the user needs to enter the OTP and click on the “verify OTP’ button to verify the same and validate the process.

- which will provide the user with their choice of user ID or username, which they plan to use to operate their account on the GST E-Way Bill Portal. The username should be about 8 to 15 alphanumeric characters and will also include special characters.

- Once a registration request is submitted, the system validates the entered values. If no error is found in the system, it will issue the username and password, and the status will show that the user is registered with the e-way bill system.

- The GST taxpayer can use this registered username and password to work on the system and generate an e-way bill per their requirements.