HSN Code Search Online and HSN Code Information Tool

Search For HSN Code information online

GST SOFTWARE FOR CAS & TAX PROFESSIONALS

Plans starting from Rs. 4,999/- for year Completely online process

Enter HSN Code of the Product*

Want to open Suvidha Kendra(Center)?

Click here to Open Suvidha KendraNo Results Found for HSN Code :

Search Result based on HSN Code :

| Type | Code | Description | IGST | CGST | SGST | UGST |

|---|

What is HSN Code ?

Harmonized Commodity Description and Coding System generally refers to “Harmonized System of Nomenclature” or simply “HSN”. It is a multipurpose international product nomenclature developed by the World Customs Organization (WCO).

How does HSN Code work ?

HSN code results in a six-digit code for a commodity that classifies about more than 5,000 products that are accepted worldwide.

What is HSN Code in India ?

India, a member of WCO since 1971, has been using HSN codes since 1986 to classify commodities for Customs and Central Excise. Later Customs and Central Excise added two more digits to make the codes more precise, resulting in an eight-digit classification.

HSN under GST

In GST, all goods and services supplied in India have been classified - Goods are classified under the HSN Code and Services are classified under the SAC Code. Based on the HSN or SAC code, GST rates have been fixed in five slabs, namely 0%, 5%, 12%, 18% and 28%.

Under GST, the majority of dealers will need to adopt two-, four-, or eight-digit HSN codes for their commodities, depending on their turnover the year prior.

- Dealers with turnover of less than Rs 1.5 crores will not be required to adopt HSN codes for their commodities.

- Dealers with turnover between Rs 1.5 crores and Rs 5 crores shall be required to use 2 digit HSN codes for their commodities.

- Dealers with turnover equal to Rs 5 crores and above shall be required to use 4 digit HSN codes for their commodities.

- In the case of imports/exports, HSN codes of 8 digits shall be compulsory, as GST has to be compatible with international standards and practices.

Understanding HSN code

The HSN structure contains 21 sections, with 99 Chapters, about 1,244 headings, and 5,224 subheadings.

- Each Section is divided into Chapters. Each Chapter is divided into Headings. Each Heading is divided into Sub Headings.

- Section and Chapter titles describe broad categories of goods, while headings and subheadings describe products in detail.

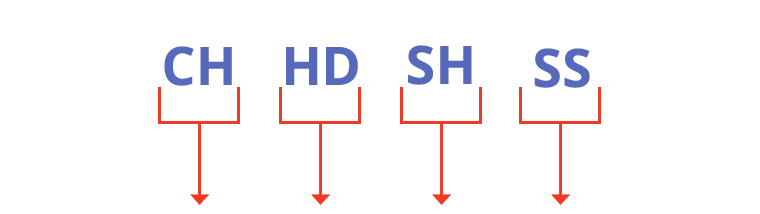

HSN Number Format & Structure

HSN Code Identifiaction Number

Format of HSN Code

- First two digits (CH) represent the chapter number.

- Next two digits (HD) represent the heading number for materials

- Next two digits (SH) is the product code for materials.

- Next two digits (SS) is the product sub division code materials.

What is SAC?

Similar to HSN,India also adopted SAC. SAC(Services Accounting Code) is a unified code for recognition, measurement and taxation for services.SAC has been in existence from the previous regime itself, and have been defined for each type of service by the government for the proper levy of Service Tax. The same code is expected to continue in the GST era.

What is importance of HSN ?

The vision of HSN is to classify goods from all over the World in a systematic and logical manner. It is a six digit uniform code that classifies more than 5,000 products and is accepted worldwide. These set of defined rules is used for taxation purposes in identifying the rate of tax applicable to a product in a country.

What is importance of HSN when Filing Invoice ?

GST returns are completely automated, it will be hard for the dealers to upload the description of the products being supplied. Hence, HSN Codes shall be automatically picked up from the registration details of the dealer and will reduce the efforts thereby. Dealers have to be careful in choosing the correct HSN/SAC code while migrating to GST or making a fresh registration.

Who are not required to use HSN?

Dealers with turnover of less than Rs 1.5 crores will not be required to adopt HSN codes for their commodities.

How to search HSN ?

First narrow down to Chapter, then Section. Then select a HSN code which best describes your commodity.

How to complain about illegality of HSN Code?

You can inform to the respective authorities [Gurgaon / Noida] know of the illegality usage of GST Number by e-mailing them and also call them at https://www.gst.gov.in/contact | +91 124 4688999 / +91 120 4888999.

HSN/SAC codes are unique identification codes for products and services in GST. HSN Code refers to Harmonized System of Nomenclature. Search and Find HSN Codes, SAC codes & GST Rates of goods and services under GST in India using MasterGST GST Software. To make the dealers work simplified while filing Invoice MasterGST Software provides a tool for the HSN/SAC code search to know the exact code of the product. The HSN/SAC code will automatically load the description of the products being supplied.

Use MasterGST GST Calculator tool to Know the Total Amount. Our MasterGST GST Software for filing the Invoices which contains all HSN Codes inbuilt that make the dealers work simplified by automatically load the description of the products being supplied.