India's Best GST Software for Accounting, Return Filling & Billing

Experience The Ease Of GST Filing

GST Software features - MasterGST

"Please Signup Explore the Features of MasterGST - A GST Software - A licensed GSP"

How to file GST returns in 3 steps.

MasterGST GST Billing Software designed to GST Returns in 3 clicks.

- Add / Import Invoices

- Upload Invoices

- Submit & File your Returns.

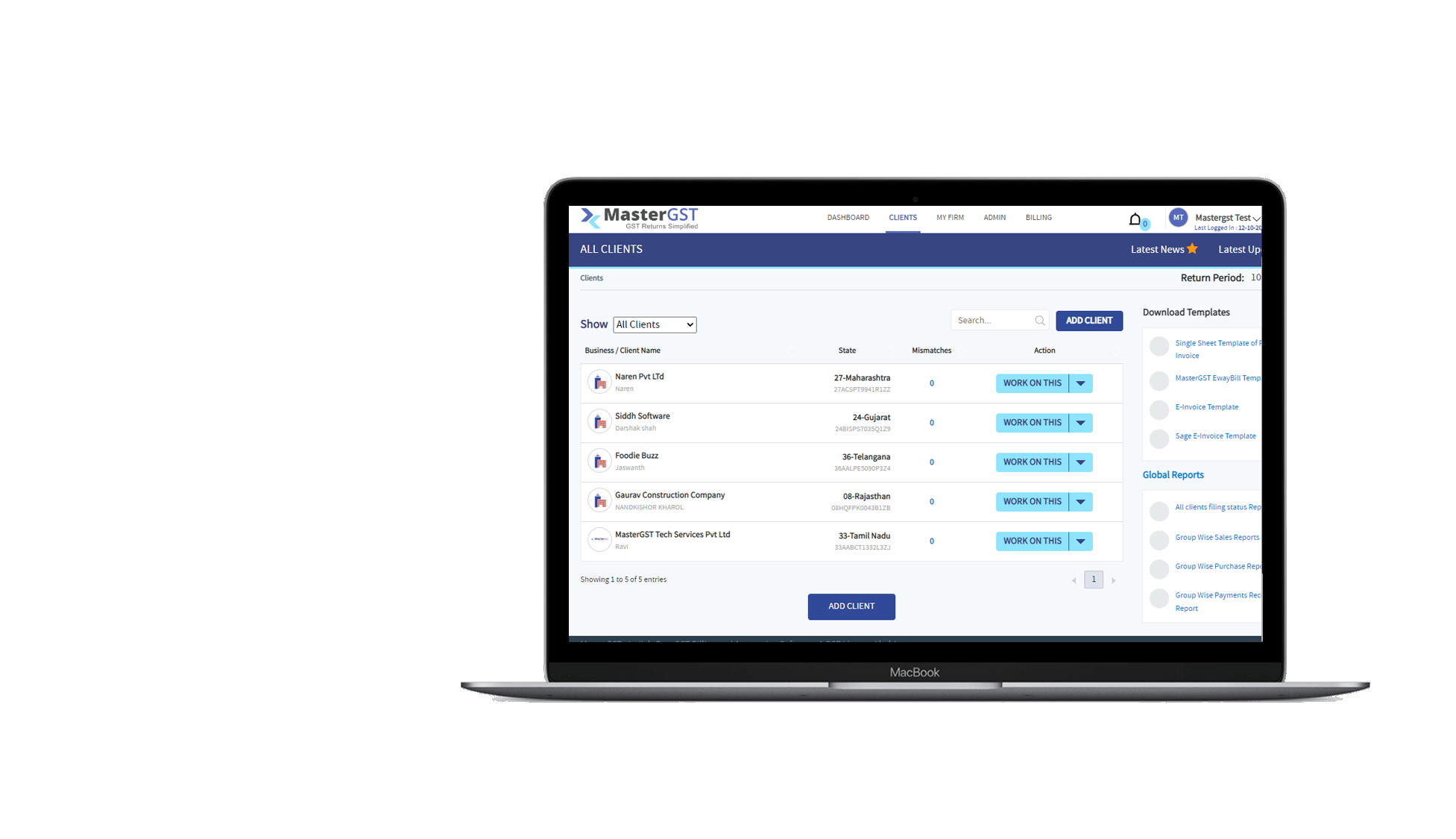

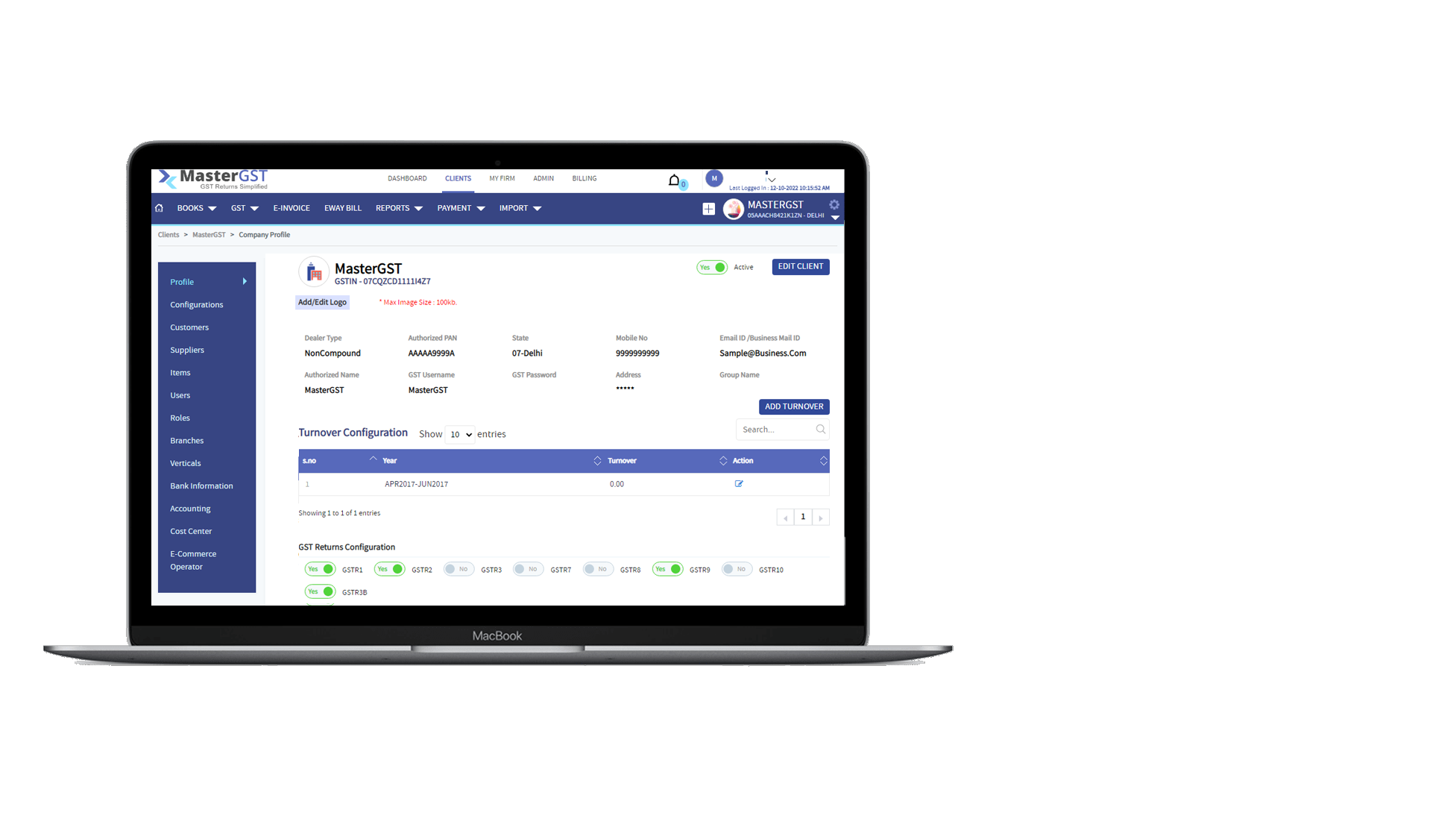

One Stop to Manage all your clients / Businesses / GSTNs

MasterGST GST Software is designed to manage multiple clients / GSTNs / Businesses in one place, a One-time effort of adding your client and managing all at one place and avoiding OTP generation all the time. While adding your client, you can validate your client details, GSTN Number, and GST user name.

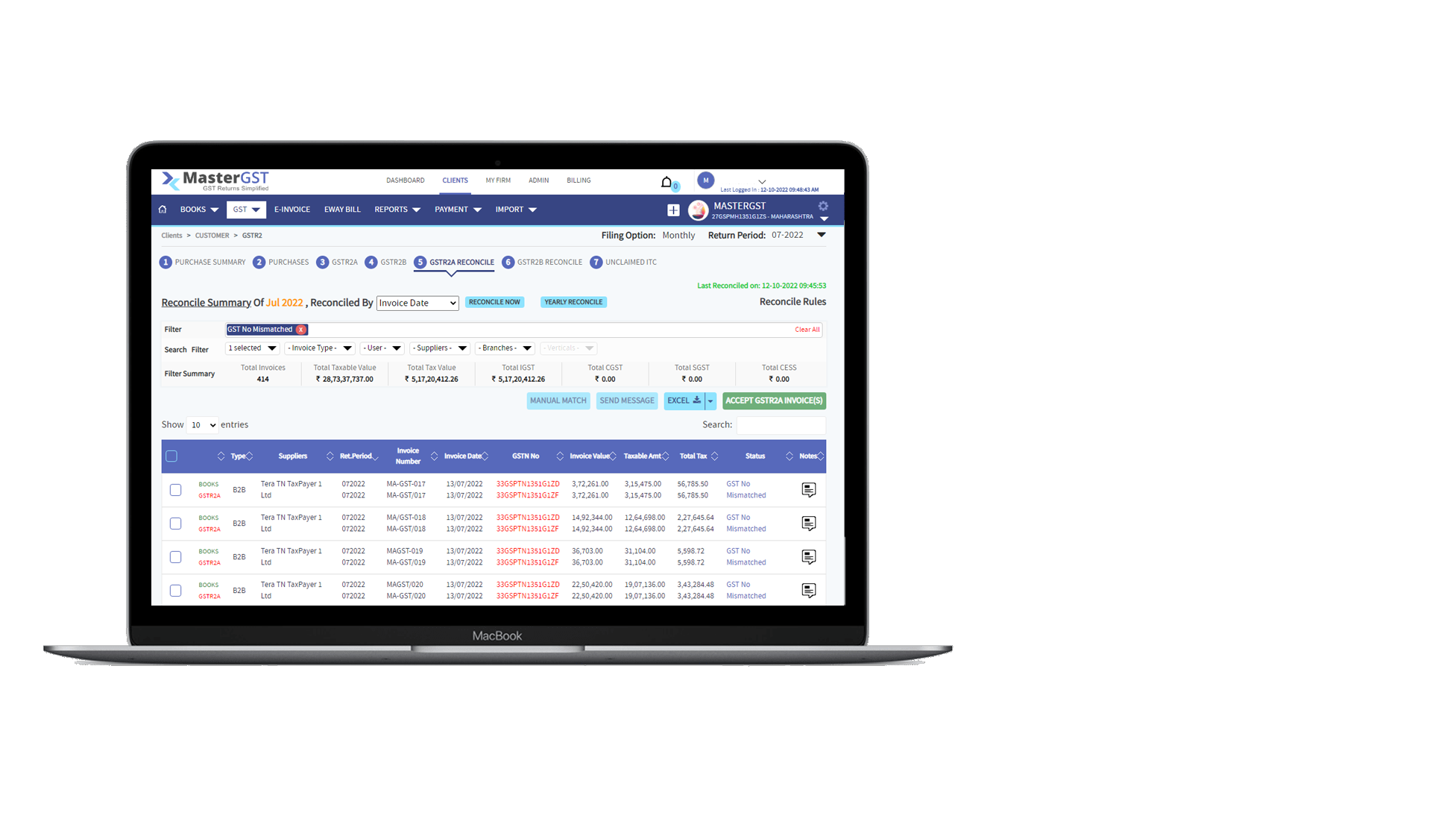

Automatic Reconciliation and Shows Mismatch of invoices

Purchase Invoice Reconciliation is a crucial process and a big hassle for anyone to handle when you have a volume of invoices. MasterGST GST Software automatically downloads from GSTN, compares to your purchase invoices, and shows the Mismatch invoices for your acceptance.

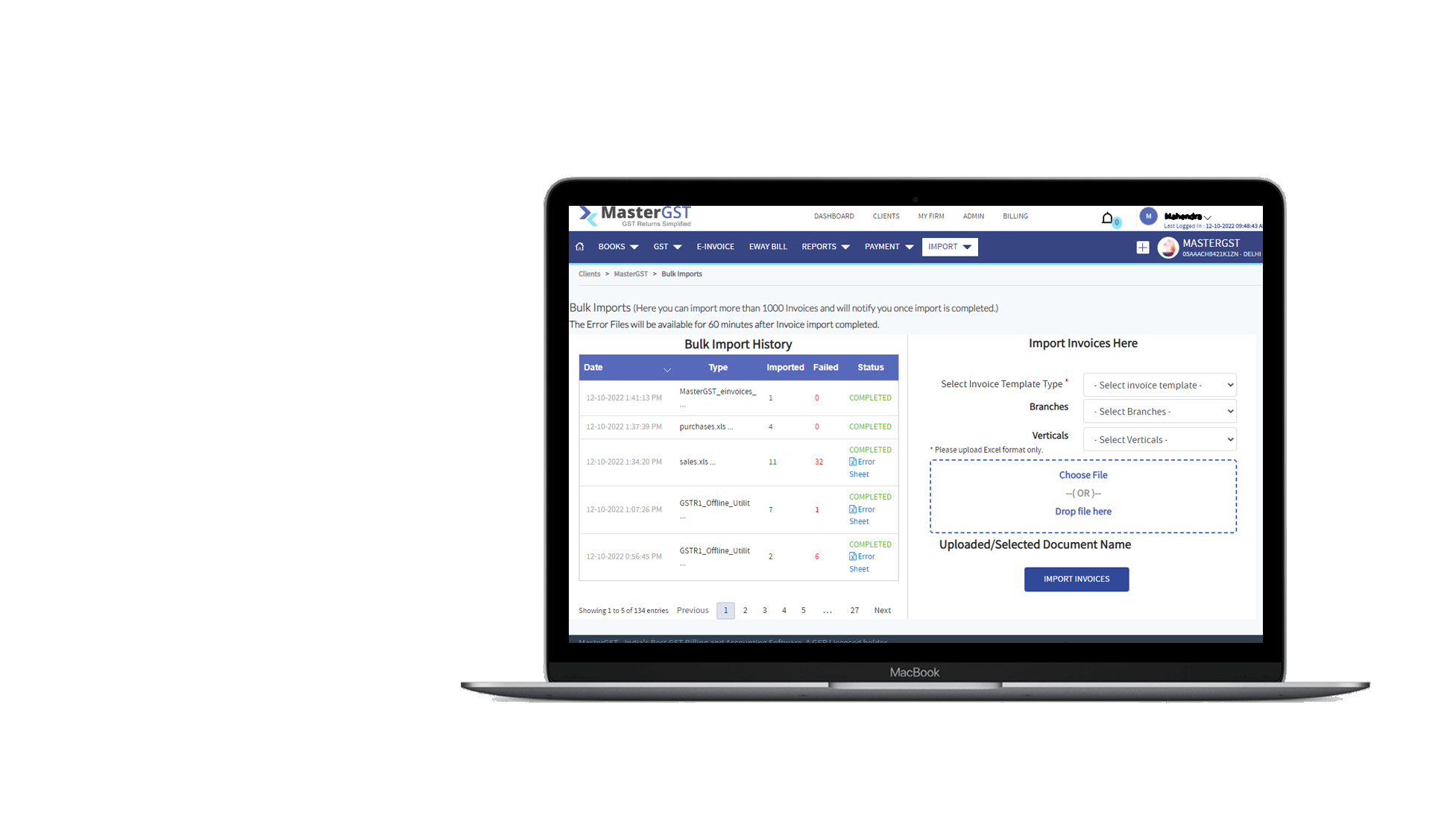

Bulk Data Import and Export Errors to Excel

MasterGST GST Software allows to Import volume of invoices in multiple ways. Excel Import, Tally Excel Import, ERP Connectors. We validate and show any issues while import and generate the errors to download and correct them then re-import. Click away to import bulk invoices.

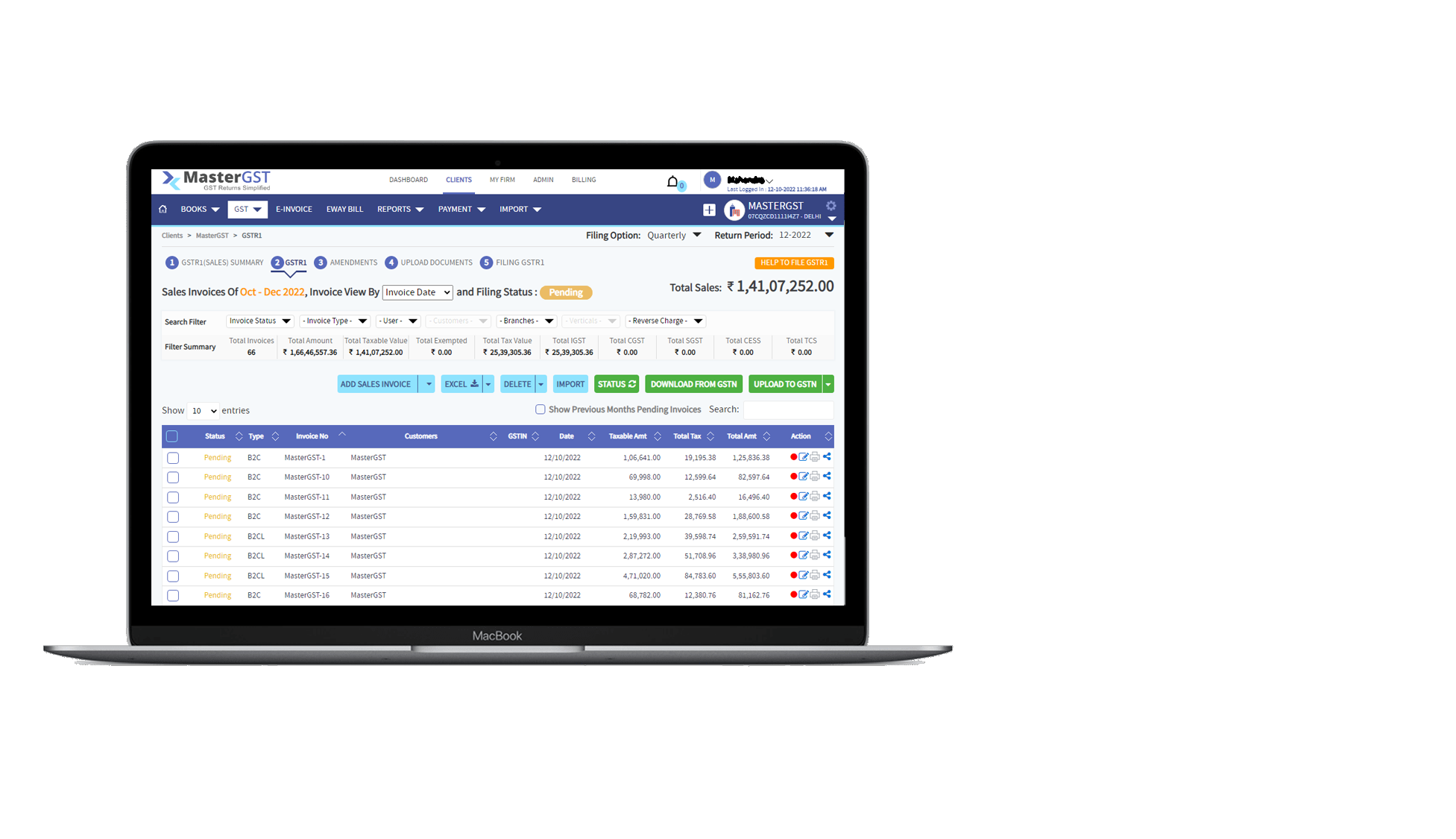

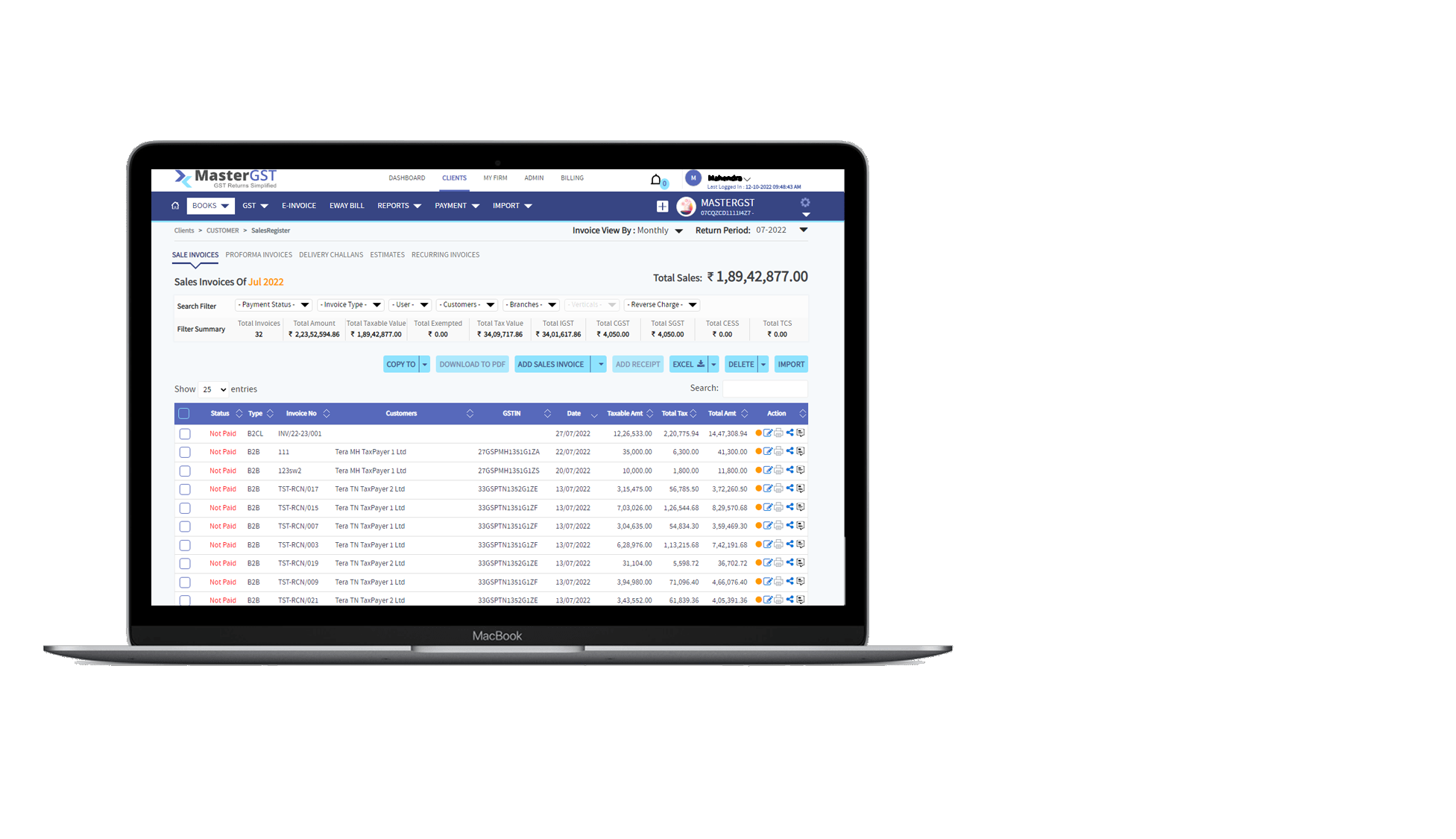

Track by invoice wise status

Still worried of to confirmation of invoices are uploaded correctly? MasterGST GST Software designed to help everyone to understand and confirms invoices are updated correctly or not with GSTN. You can see how many invoices in pending, uploaded and failed to upload. Any errors in Invoices you can see it and correct for failed invoices.

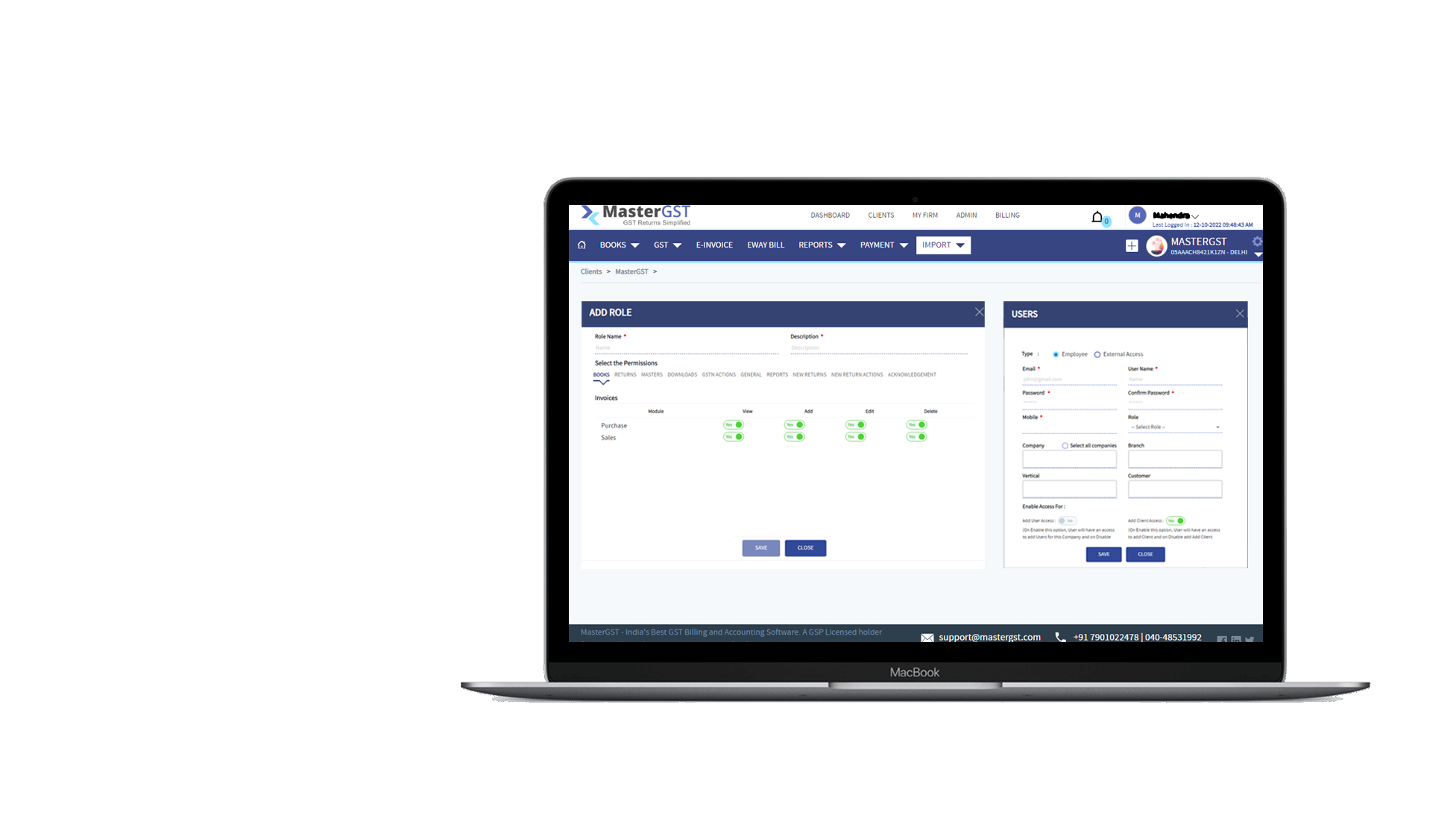

Role Based and Real Time Data access

MasterGST GST Software is designed to manage your team, multiple organizations/audit firm, and users. User level restrictions, Role level Restrictions, Superuser control mechanisms, and all users can work on real-time data. Also, you can create a user for your clients to review or correct invoices.

Master Data Management

MasterGST understands how hard it is to enter the data every time, so manage master data for each client. So it will make data entry pretty easy, and all the data is available at your fingers, and as you type, you get client-specific vendors, suppliers, Item Masters, products, and services data.

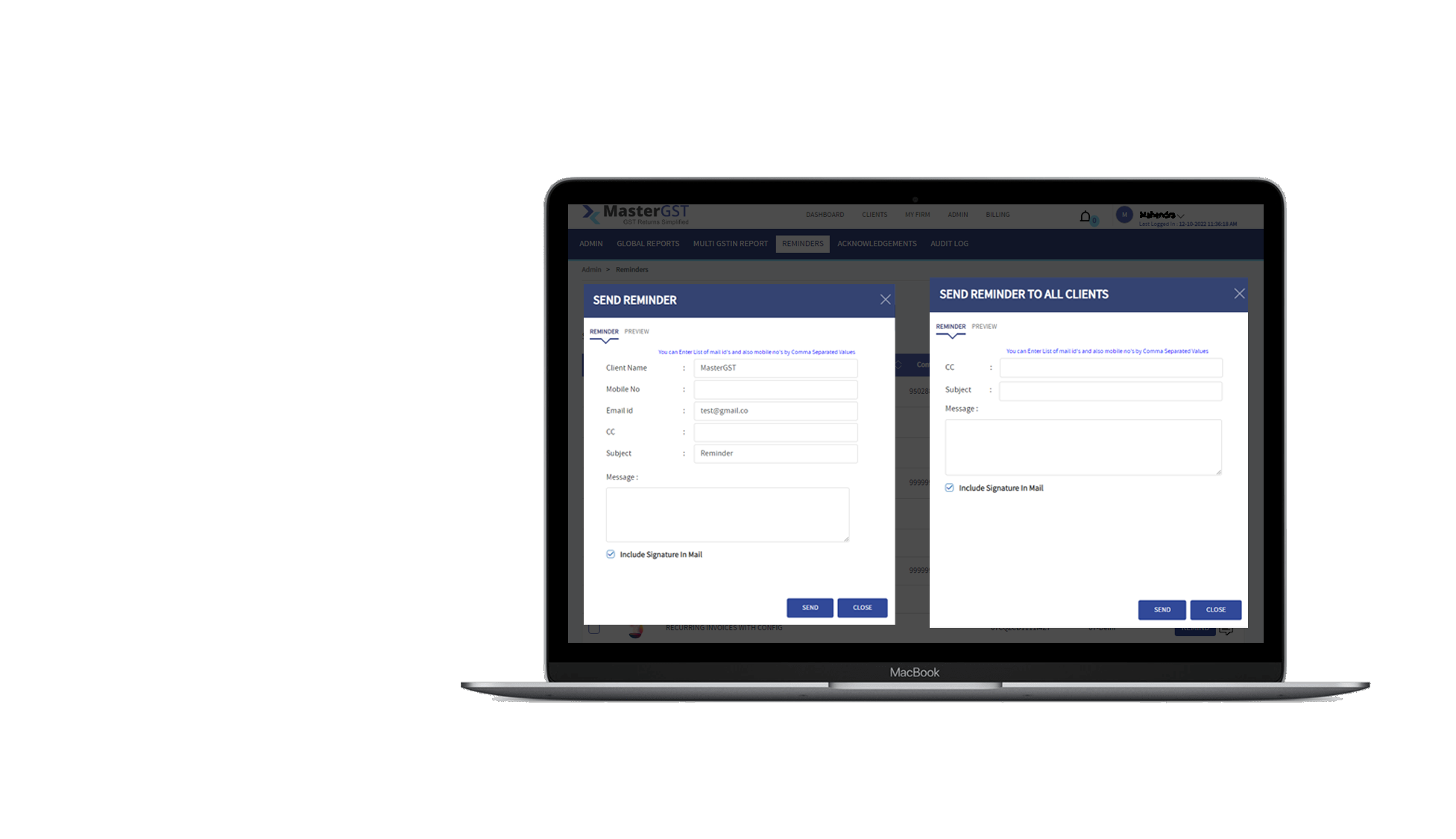

Reminders

MasterGST GST Software is designed to manage your team, multiple organizations/audit firm, and users. User level restrictions, Role level Restrictions, Superuser control mechanisms, and all users can work on real-time data. Also, you can create a user for your clients to review or correct invoices.

MasterGST - Our Software Uses In

"Please Signup Explore the Features of MasterGST - A GST Software - A licensed GSP"

Health care & Pharma

Banking & Finance

Media & Telecom

Government Sector

Hotel & RESTAURANTS

Educational Institutes

Manufacturing Industries

Software Companies

MasterGST - Frequently Asked Questions

"Please Signup Explore the Features of MasterGST - A GST Software - A licensed GSP"

Goods and Services Tax (GST) is an indirect tax applicable throughout India which replaced multiple cascading taxes levied by the central and state governments.

All businesses that successfully register under GST are assigned a unique Goods and Services Tax Identification Number also know as GSTIN.

In India, a dual GST is proposed whereby a Central Goods and Services Tax (CGST) and a State Goods and Services Tax (SGST) will be charged on the taxable value of every transaction of supply of goods and services.

The government does not charge any registration fee to the taxpayer. However, the process of registration is a little lengthy and thus professional fee may be charged by GST Practitioner or CA.

Any person with a taxable supply turnover of over Rs.25 lakhs is required to register for GST in India. There is also a mechanism available for voluntary GST registration to help claim input tax credit.

Accordingly, ‘aggregate turnover’ means ‘Value of all supplies (taxable and non-taxable supplies + Exempt supplies + Exports) and it excludes Taxes levied under CGST Act, SGST Act and IGST Act, Value of inward supplies + Value of supplies taxable under reverse charge of a person having the same PAN.

HSN (Harmonized System of Nomenclature) code shall be used for classifying the goods under the GST regime. Taxpayers whose turnover is above Rs. 1.5 crores but below Rs. 5 crores shall use 2 digit code and the taxpayers whose turnover is Rs. 5 crores and above shall use 4 digit code. Taxpayers whose turnover is below Rs. 1.5 crores are not required to mention HSN Code in their invoices. Services will be classified as per the Services Accounting Code (SAC)

The CGST and SGST would be levied at rates to be jointly decided by the Central and States. The rates would be notified on the recommendations of the GST Council.

Supply of goods and/or services. CGST & SGST will be levied on intra-state supplies while IGST will be levied on inter-state supplies.

Imports of Goods and Services will be treated as inter-state supplies and IGST will be levied on import of goods and services into the country. The incidence of tax will follow the destination principle and the tax revenue in case of SGST will accrue to the State where the imported goods and services are consumed. Full and complete set-off 14 15 will be available on the GST paid on import on goods and services.

No, reverse charge applies to supplies of both goods and services.

Central Government or State Government on the recommendation of the GST Council can notify a transaction to be the supply of goods and/or services.

The threshold for composition scheme is Rs. 50 Lakhs of aggregate turnover in financial year.

1%

For alcohol, states don’t want to lose the significant revenue currently earned from state excise duty. In many states, the revenue from state excise taxes imposed on alcohol and petroleum brings in 33 % of total revenue. Because of this reason, the state excise tax on alcohol has been kept out of the constitutional mandate for charging GST.

The Goods and Services Tax (GST) is a major step to simplify the tax structure of India. The Goods and Services Tax Bill (GST Bill) initiates a Value added Tax to be implemented on a national level in India. One of the main reason for GST Bill is to introduce and bring uniformity in the system.Upon implementation of GST, Central and State taxes will combine into single tax payment. In order to avoid the payment of multiple taxes such as excise duty and service tax at Central level and VAT at the State level, GST would unify these taxes and create a uniform market throughout the country.

No, a person without GST registration can neither collect GST from his customers nor can claim any input tax credit of GST paid by him.

Yes. In terms of sub-section 10 of section 25 of the CGST/SGST Act, the proper officer can reject an application for registration after due verification.

If a business operates from more than one state, then a separate GST registration is required for each state.

In case registration is granted; applicant can download the Registration Certificate from the GST common portal.