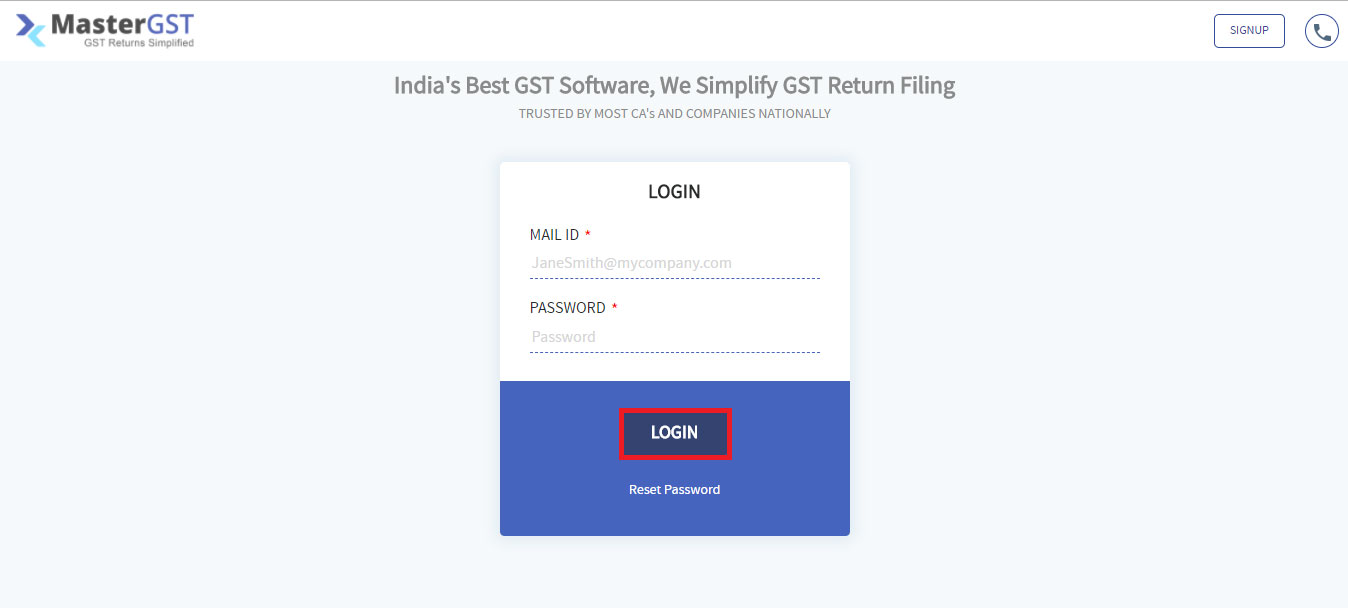

Step1 :

Login into MasterGST using same email and password as you registered.

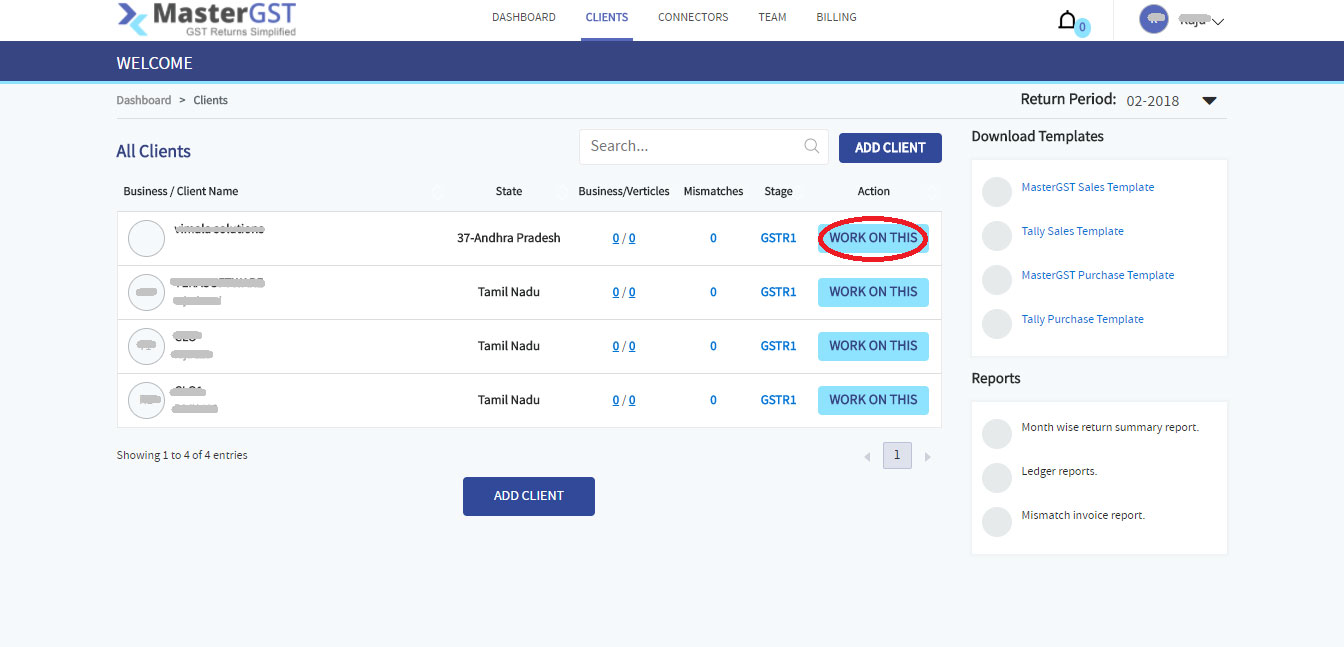

Step2 :

After Login Click On clients in menu , you will the get clients page ( please refer ‘how to add clients‘ if you don’t no how to add a client ).

Step3 :

Select for which client you want add GSTR3B Invoice by using Work on this button.

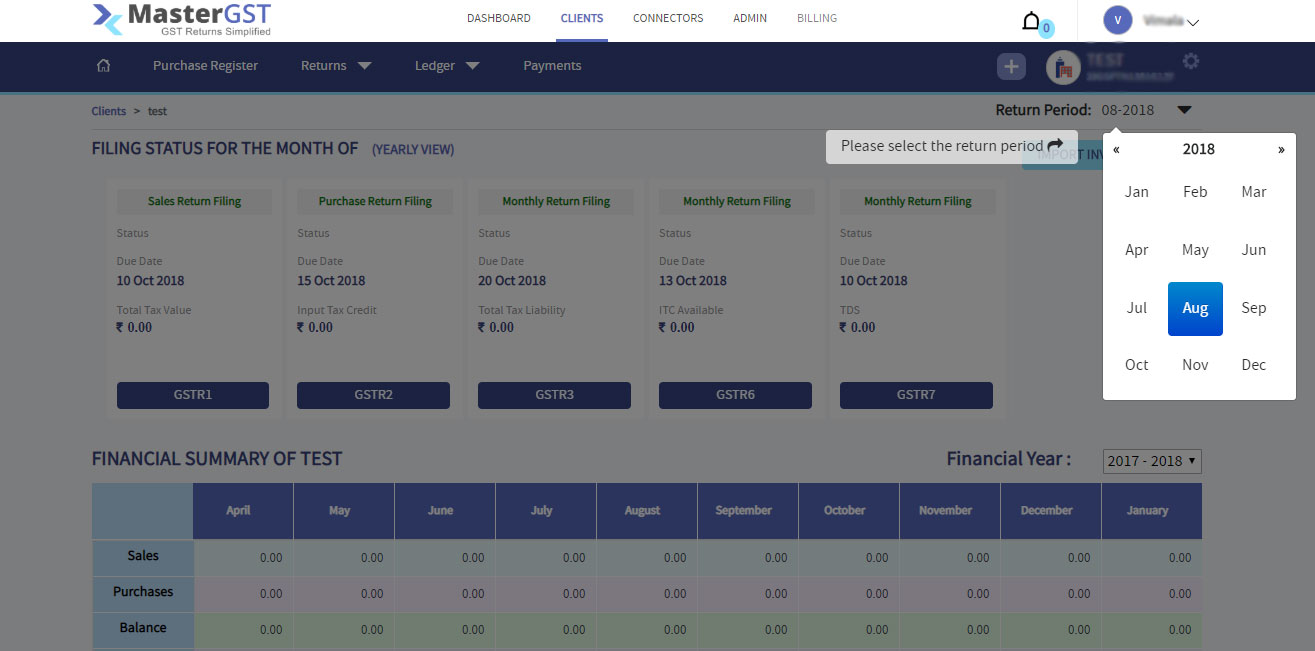

Step4 :

You will get a pop up calendar, Select for which month you want to add invoice.

Step6 :

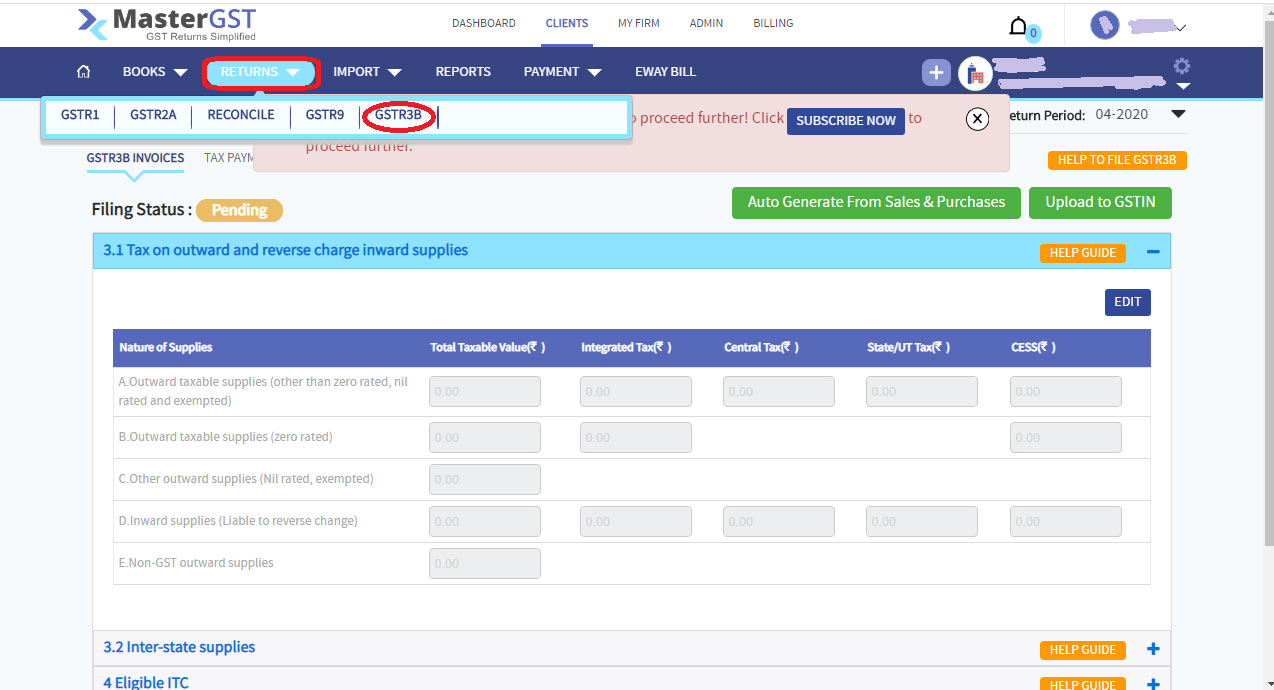

Click on returns in navigation menu, in That Dropdown select GSTR3B.

Step7 :

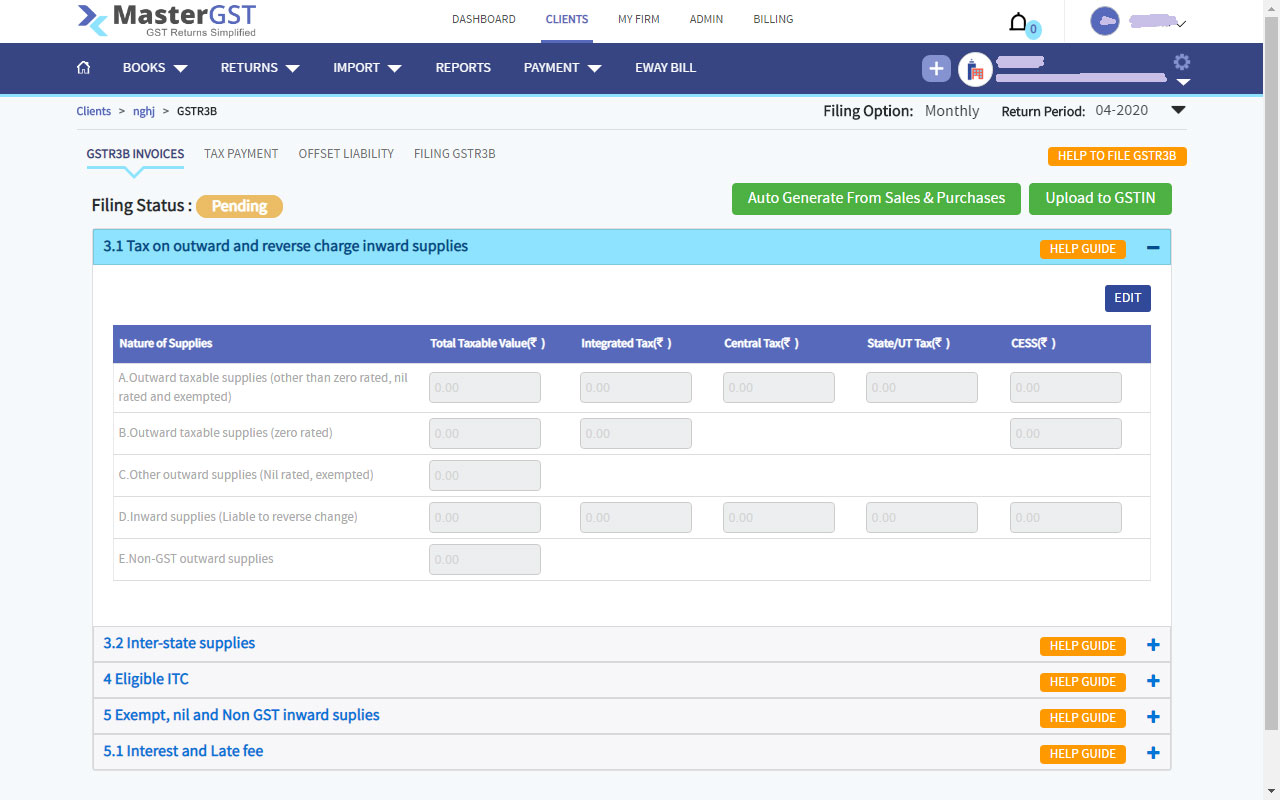

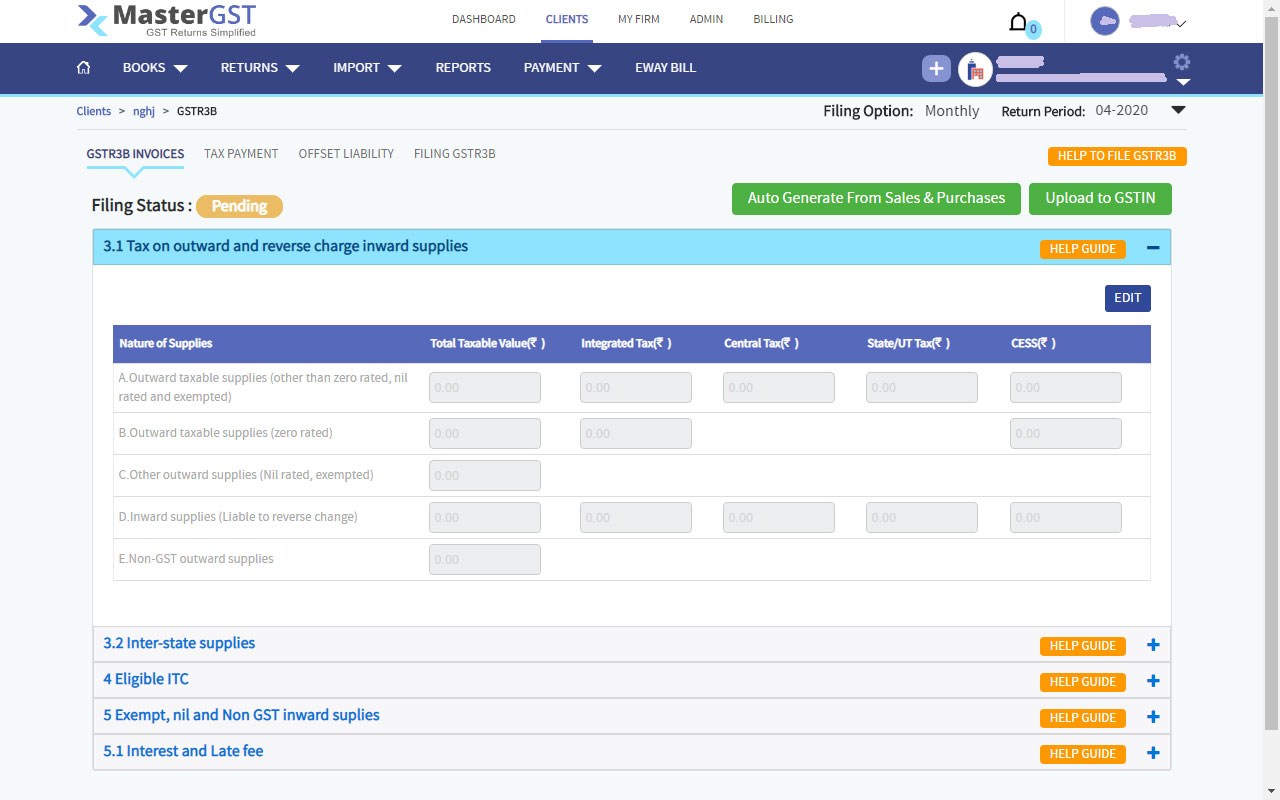

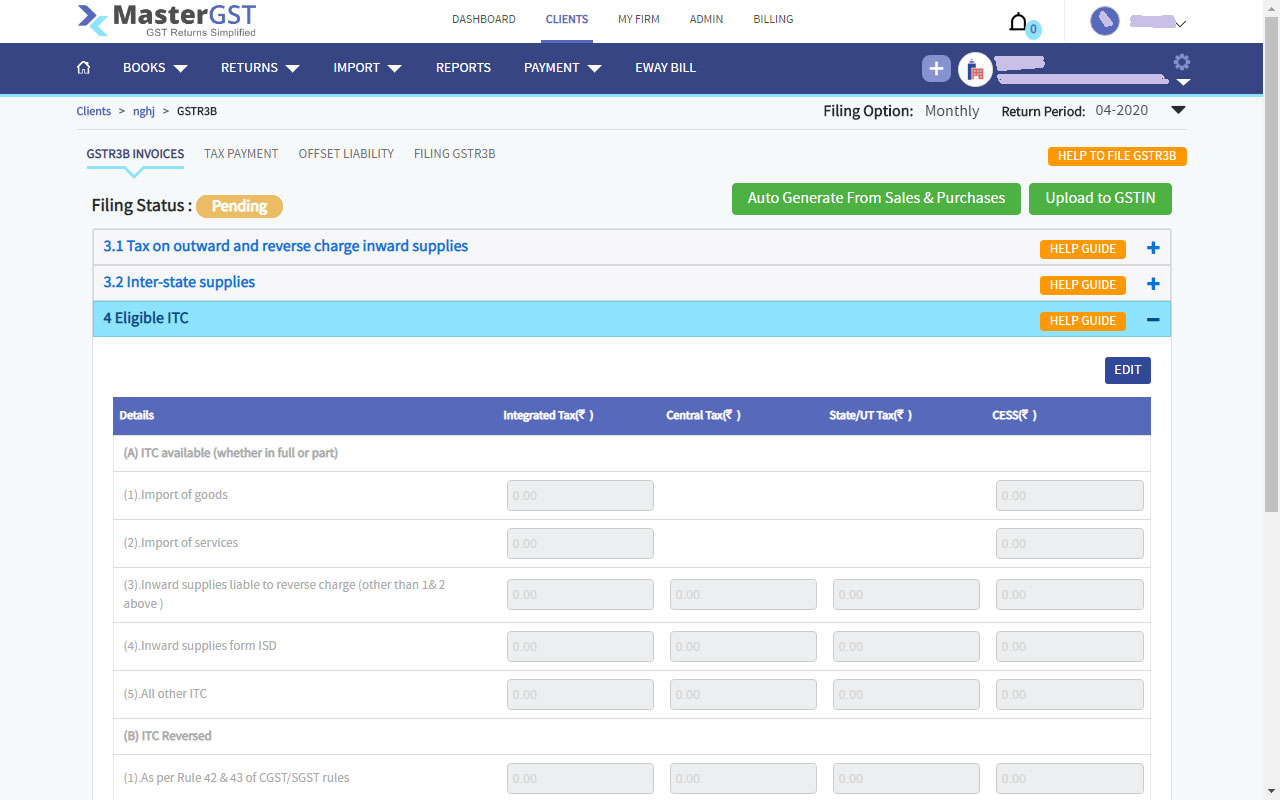

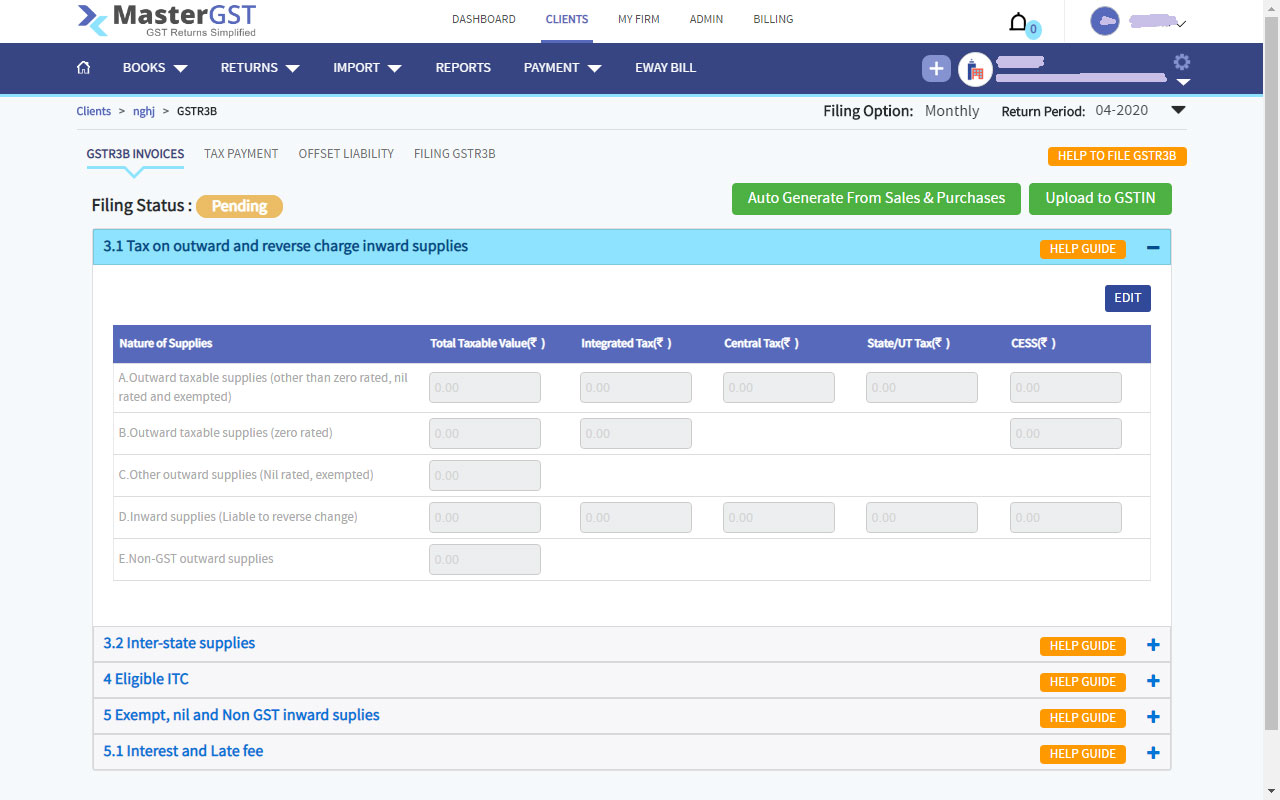

You will get a page with tabs, In GSTR3B INVOICES tab need to fill all the details.

3.1 Tax on outward and reverse charge inward supplies

Click on edit button to enter the values in GSTR3B , To Save the value in the table click on Save button.

Include the taxable value of all inter-State and intra-State B2B as well as B2C supplies made during the tax period. Reporting should be net off debit/credit notes and amendments of amounts pertaining to earlier tax periods, if any.

Value of Taxable Supplies: = (Value of invoices) + (Value of Debit Notes) – (Value of Credit Notes) + (Value of advances received for which invoices have not been issued in the same Month) – (Value of advances adjusted against invoices).

Integrated Tax, Central Tax, State/UT Tax and Cess: Only Tax amount should be entered against respective head. Please ensure you declare a tax amount IGST and/or CGST and SGST along with Cess applicable, if any.

3.1(b) Outward taxable supplies (zero rated)

Mention Export Supplies made including supplies to SEZ/SEZ developers. Total taxable value should include supplies on which tax has been charged as well as supplies made against bond or letter of undertaking.

Integrated Tax and Cess should include amount of tax, if paid, on the supplies made.

3.1(c) Other outward supplies (Nil rated, exempted)

Here include all outward supplies which are not liable to tax either because they are nil rated or exempt through notification. It should not include export supplies or supplies made to SEZ developers or units declared in 3.1(b) above.

3.1(d) Inward supplies (liable to reverse charge)

Include inward supplies which are subject to reverse charge mechanism. This also includes supplies received from unregistered persons on which tax is liable to be paid by recipient.

3.1(e) Non-GST Outward Supplies

Amount in Total taxable value should include aggregate of value of all the supplies which are not chargeable under GST Act e.g. petroleum products.

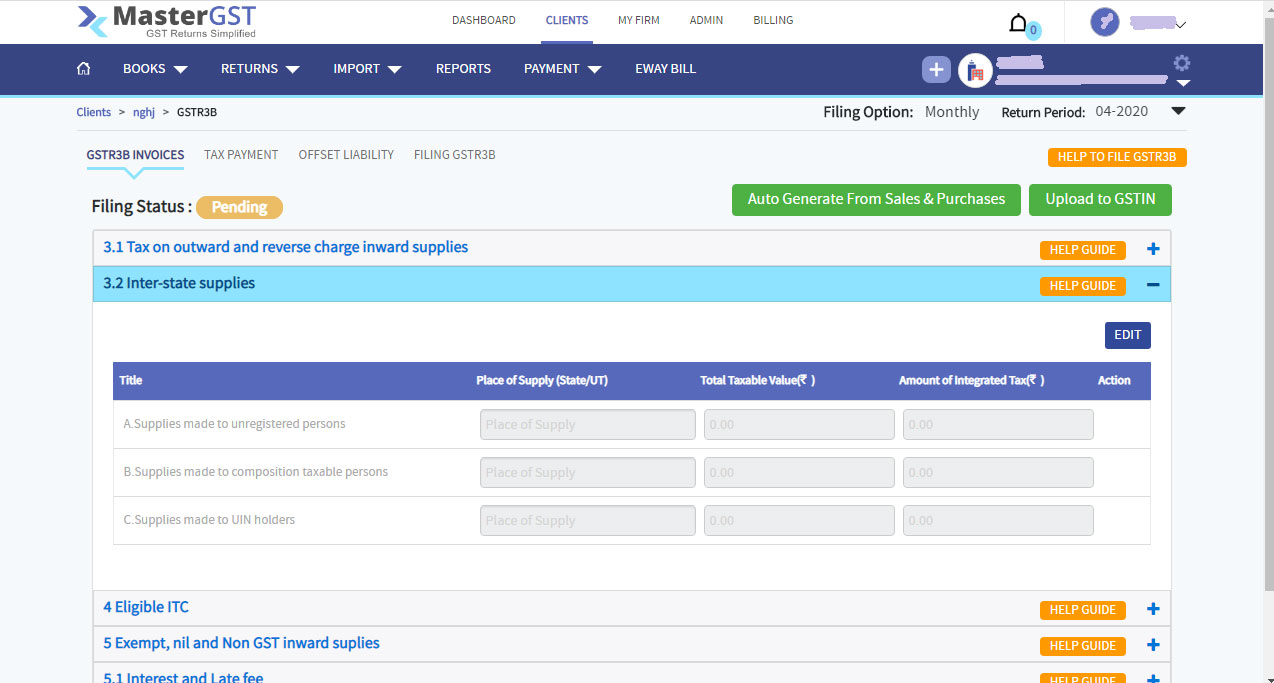

3.2 Inter State Supplies

Out of supplies shown in earlier Table (3.1), declare the details of inter-State supplies made to unregistered persons, composition taxable persons and UIN holders in the respective sub-sections along with the place of supply.

The details mentioned in this Table will not be considered in computation of output liability.

Please ensure the details of inter-State sales declared here is part of the declaration in Table 3.1 above and it doesn’t exceed the amount declared over there.

4 Eligible ITC

(A) ITC Available (whether in full or part)

Declare here the details of credit being claimed on inward supplies made during the tax period, further categorized into:

- Import of goods

- Import of Services (Should have been declared in 3.1 for tax liability under reverse charge mechanism)

- Inward supplies on which tax is payable on reverse charge basis (Should have been declared in 3.1 for tax liability on supplies attracting reverse charge) Credit received from ISD (Input Service Distributor)

- Any other credit. (This will cover all inward supplies from registered taxpayers on which tax has been charged. Transition relation credits should not be mentioned here. Transition credit should be claimed through GST TRAN-1)

- Place Of Supply: under GST defines whether the transaction will be counted as intra-state or inter-state, and accordingly levy of SGST, CGST & IGST will be determined.

B) ITC Reversed

Any reversal of ITC claimed as per applicable rules will be declared in this section and the same will be reduced from the credit as per (A) above.

C) Net ITC Available (A-B)

This section will be auto calculated by the system considering the values provided in A&B (ITC available & ITC reversed)

D) Ineligible ITC

ITC which is not eligible needs to be declared here. Please ensure it is not availed or reversed in A & B above.

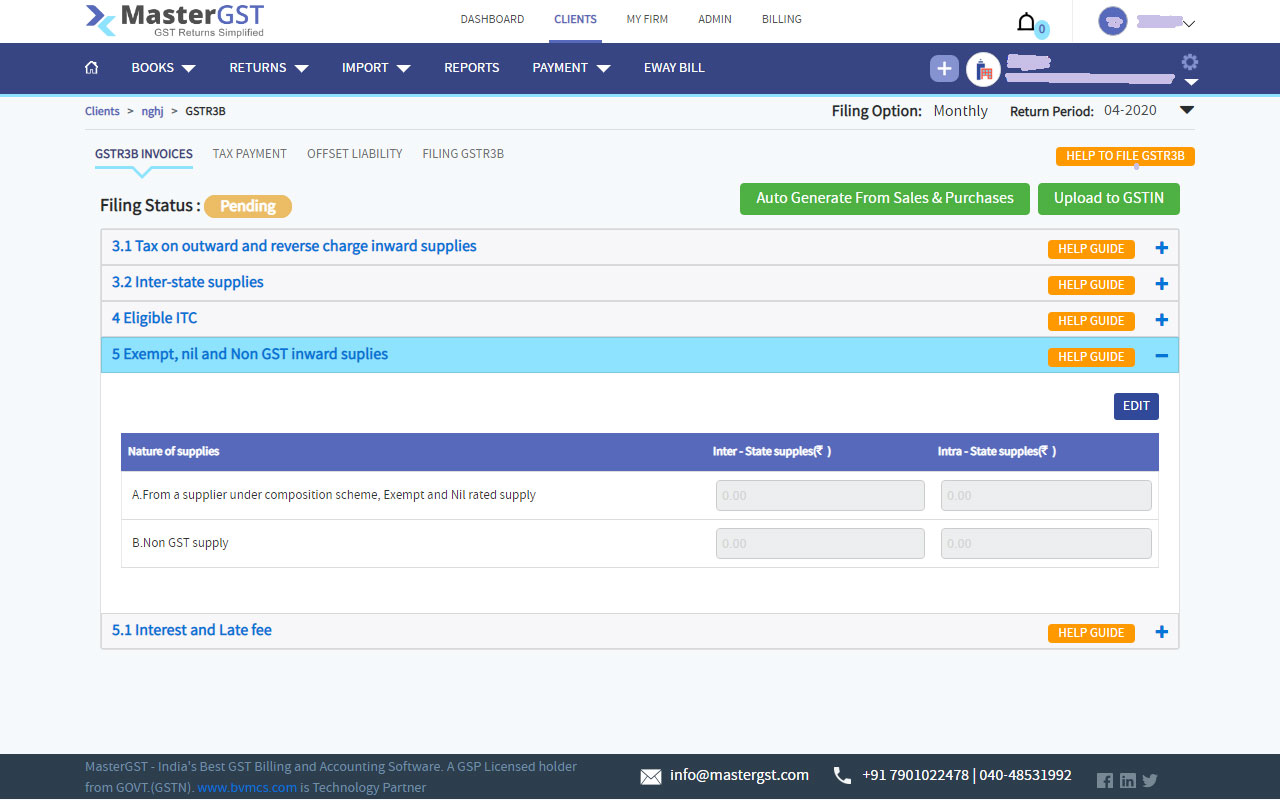

5 Exempt, nil and Non GST inward supplies

Declare the values of inward supplies with respect to the following, in this section:

- From suppliers under composition scheme, Supplies exempt from tax and Nil rated supplies.

- Supplies which are not covered under GST Act.

The above values have to be declared separately for Intra-State and Inter-State supplies.

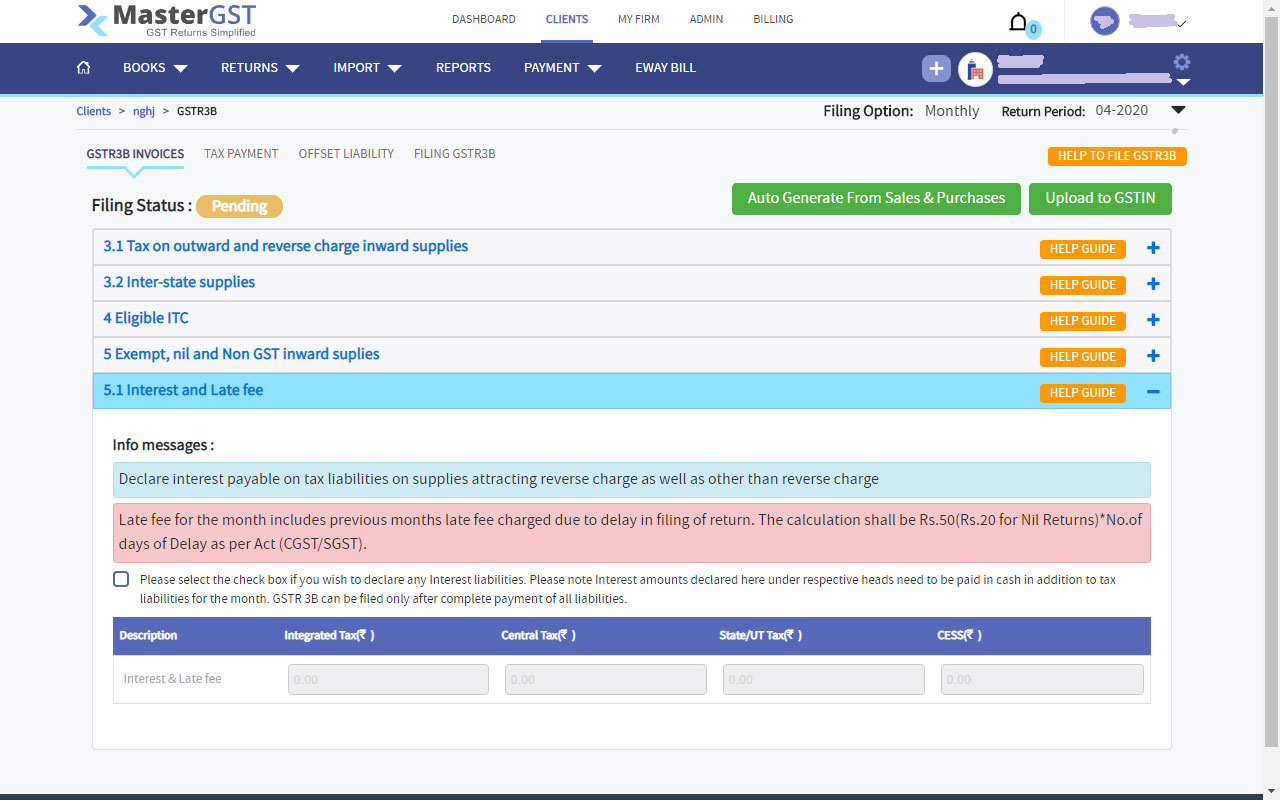

5.1 Interest and Late fee

click on checkbox if you want to declare any Interest liabilities.

Interest is payable on the delayed payment of taxes after the last date as well as for invoices/ debit notes declared in current tax period belonging to earlier tax period.

The self-calculated interest liability needs to be declared by the taxpayer in this field.

Interest for both reverse charge as well as for forward charge related liabilities needs to be declared here.

Late fee is auto calculated by the system based on the date of filing and the due date for the return. There is no late fees payable for IGST and CESS and hence the same has been disabled.

Step7 :

Click on “upload to GSTIN“. Please Note, Once you upload the Invoices, you can’t make any changes to the invoices

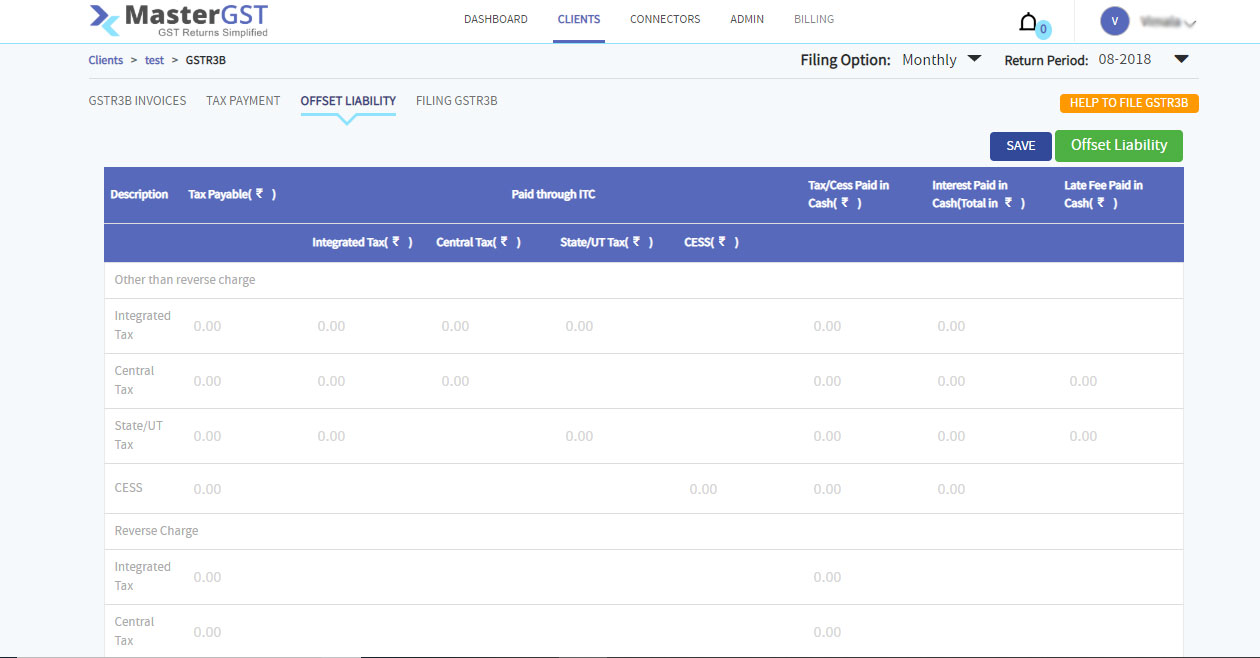

Note: Offset Liability: you receive credit for paying input tax when you procure goods and services to run your business. You are liable to pay output tax on the sales done in your business. You can offset the output tax against the input tax that you have paid. You can utilize the input tax credit (ITC) for one GST type to recover the tax liability (output tax) for another GST type. However, you must follow the order of priority prescribed by the government to offset the ITC against the tax liability of other GST types.

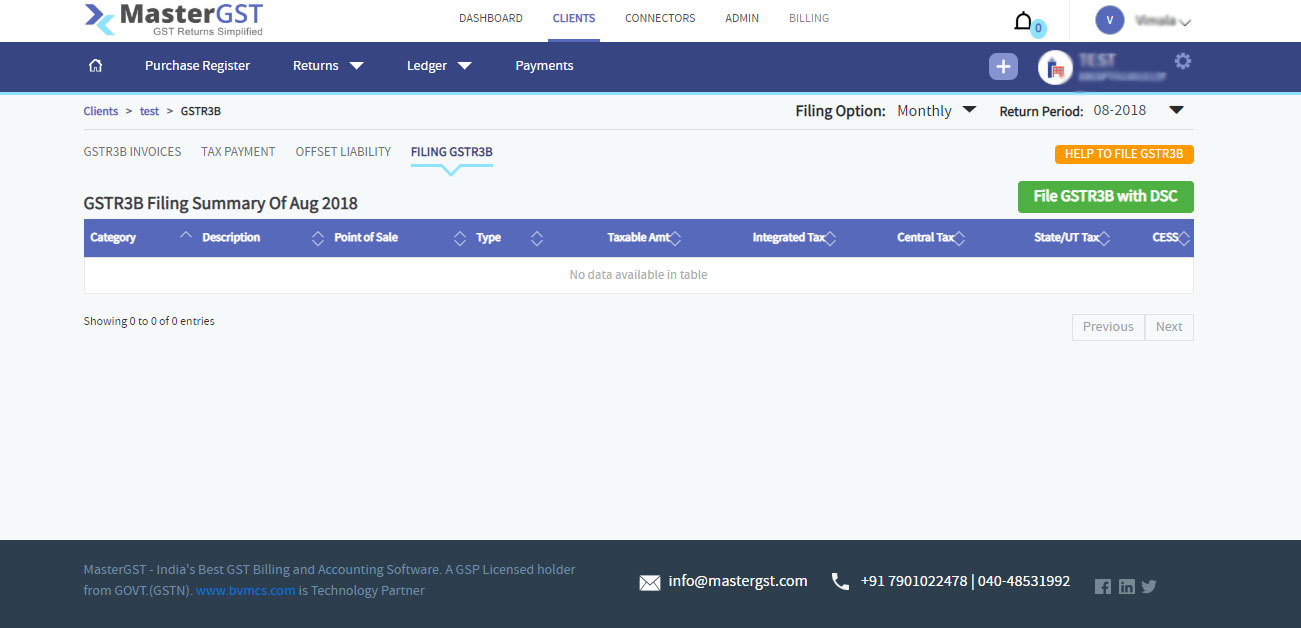

Step8 :

Enter the offset values in offset liability tab.

Step9 :

Click on “File GSTR3B with Digital Signature (DSC)”, Please login to your Digital Signature to file.