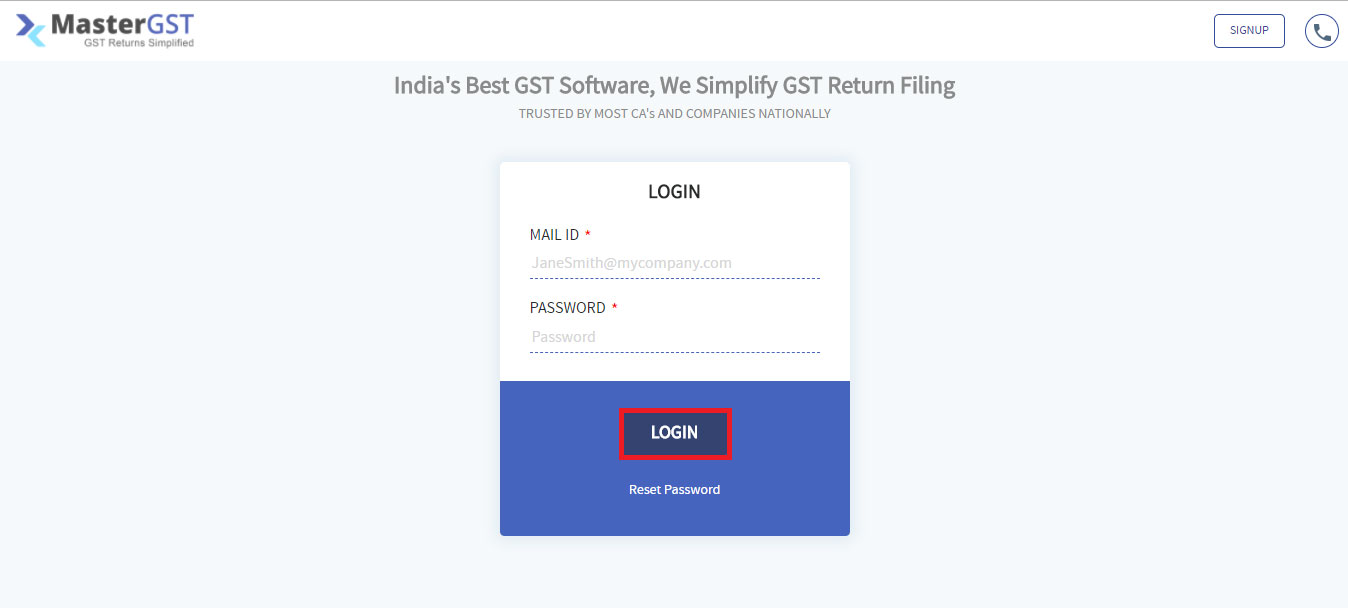

Step:1

Login into MasterGST using the same email and password as you registered.

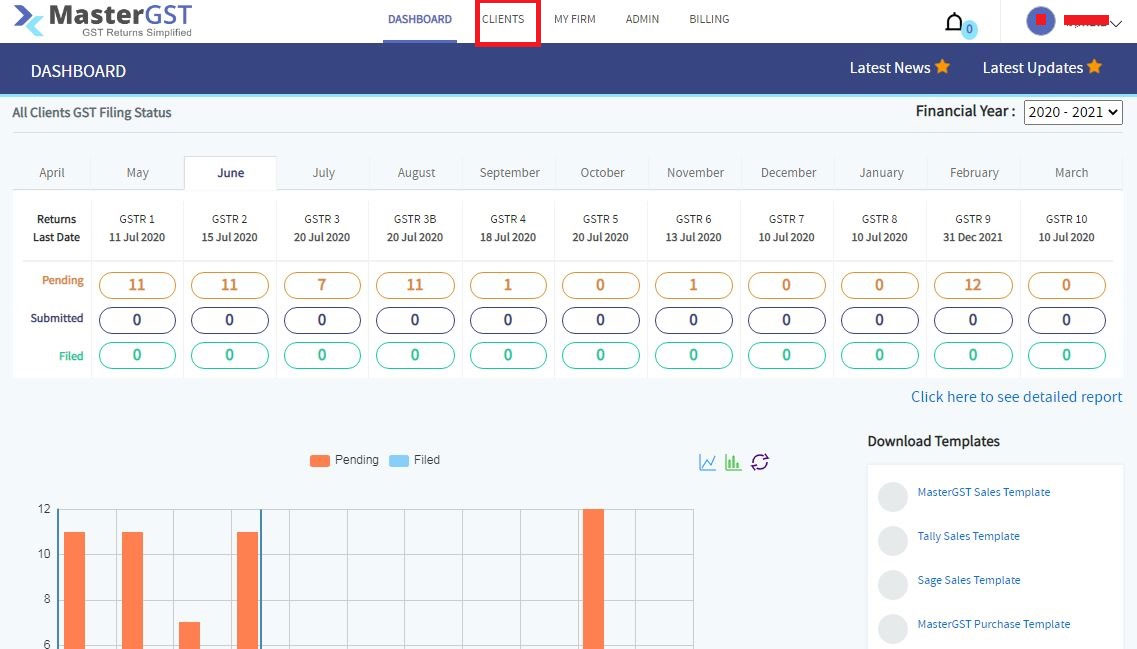

Step:2

Click on clients from the top menu bar.

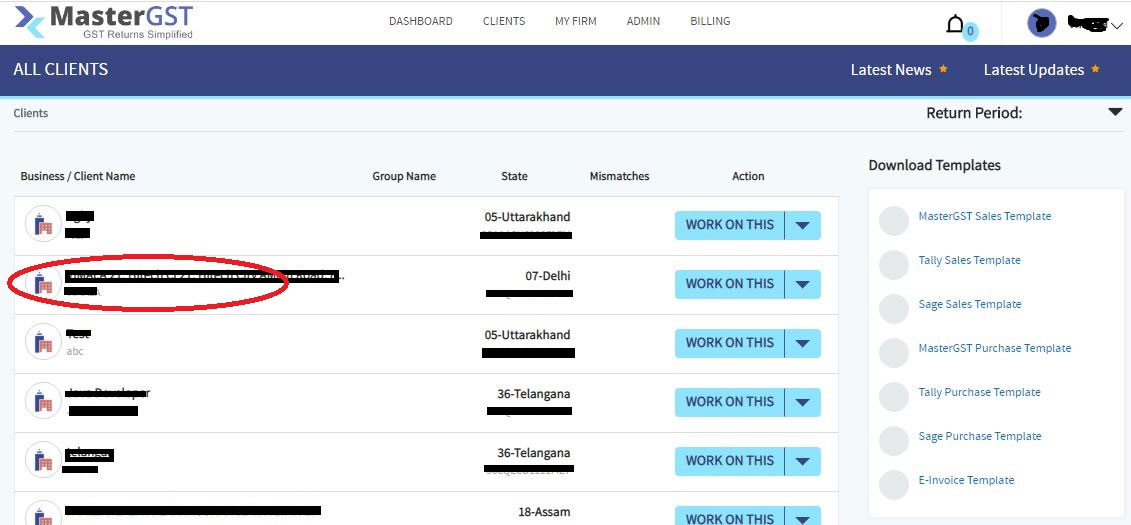

Step:3

Click on the company name. You will get a page with company details. In the Left side menu, click on Configurations.

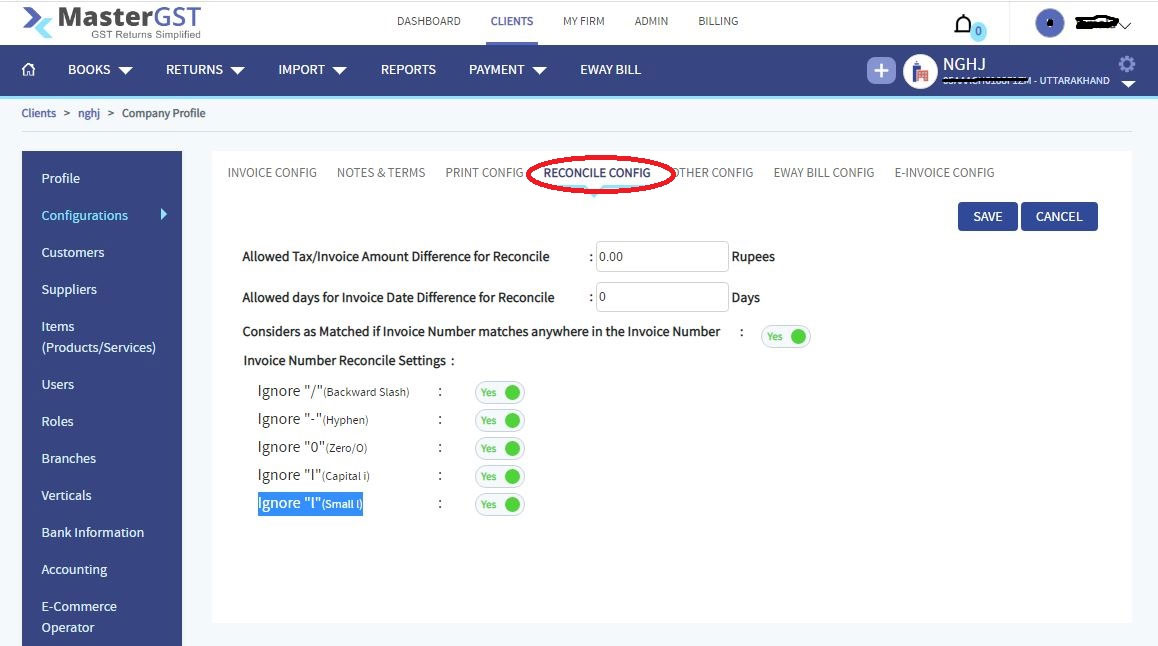

Step4 :

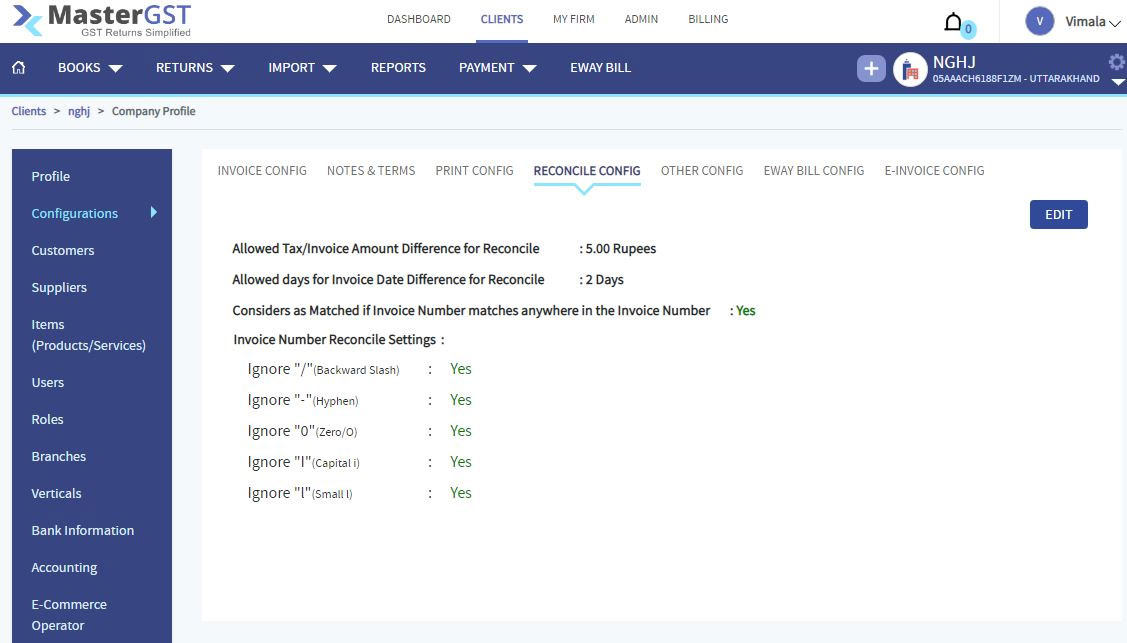

You will get a page with all Configurations. If you want to change reconcile Configurations, Click on reconcile Configurations.

Step:5

In this step, you can change the configurations, such as

- Allowed Tax/Invoice Amount Difference for Reconcile

- Allowed days for Invoice Date Difference for Reconcile

- Considers as Matched if Invoice Number matches anywhere in the Invoice Number

- Ignore “/”(Backward Slash)

- Ignore “-“(Hyphen)

- Ignore “0”(Zero/O)

- Ignore “I”(Capital i)

- Ignore “l”(Small l)

Step:6

Click on save to save all the changes.

Step:7

If you check the reconciliation, it will be according to all the above configurations.