What is GSTR5 form? Who needs to file GSTR5 ?

GSTR5 is a type of return filing that is needs to be done by a non-resident foreign taxpayer who is registered under GST. The form GSTR-5 contains the details of income and expenses related to the business of the taxpayer who is residing out of India. GSTR5 is Monthly filing.

And the Due date for this GSTR5 filing is after every month following 20th . For failed filing before 20th there will be penalty is Rs 50 per day for any tax liability and Rs 20 per day for no tax liability. If missed filing one month one can not file the following month return.

How To file GSTR5 in MasterGST

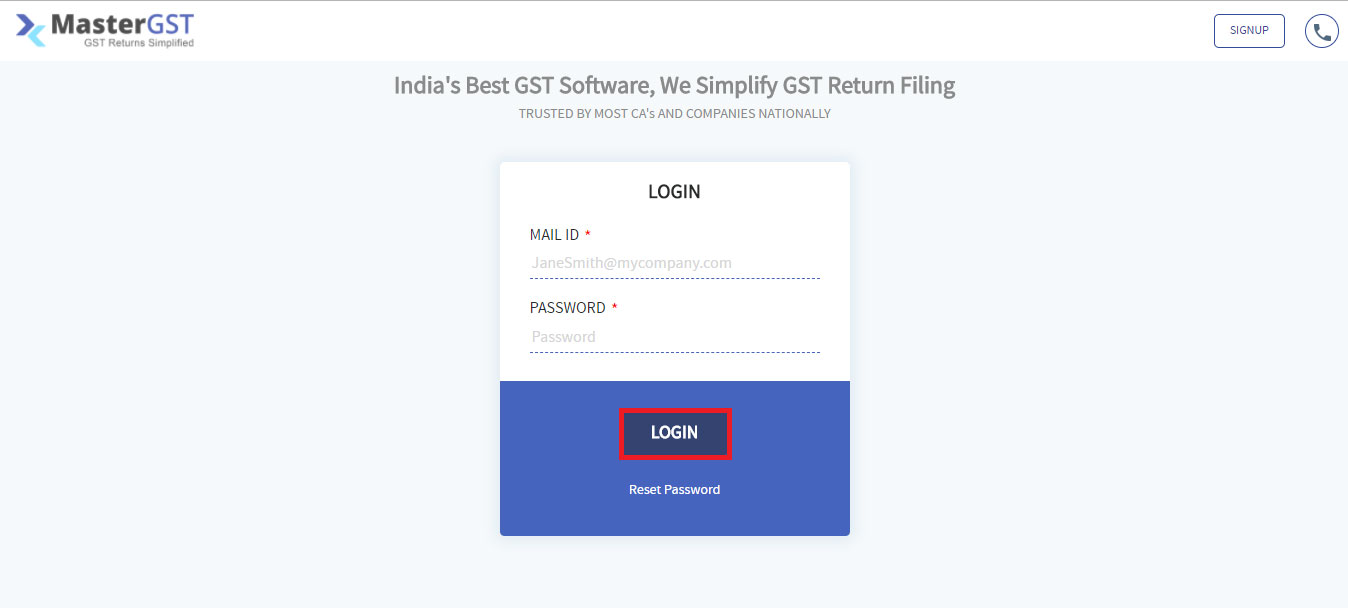

Step1 :

Login into MasterGST using same email and password as you registered.

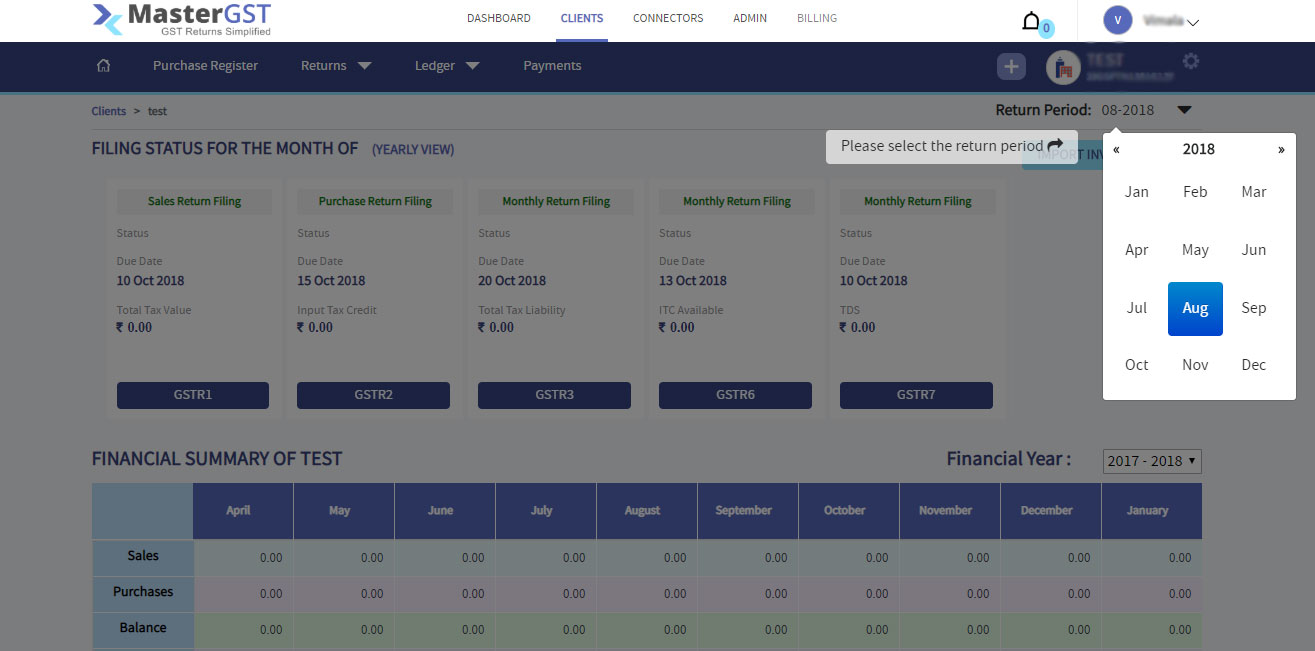

Step2 :

After adding clients, you will get the clients details in clients page (please refer ‘how to add clients‘). At the end of each client details you can see a button with text Work on this ,click on that button. You will get a pop up calendar, click on a month to which you want to add invoice.

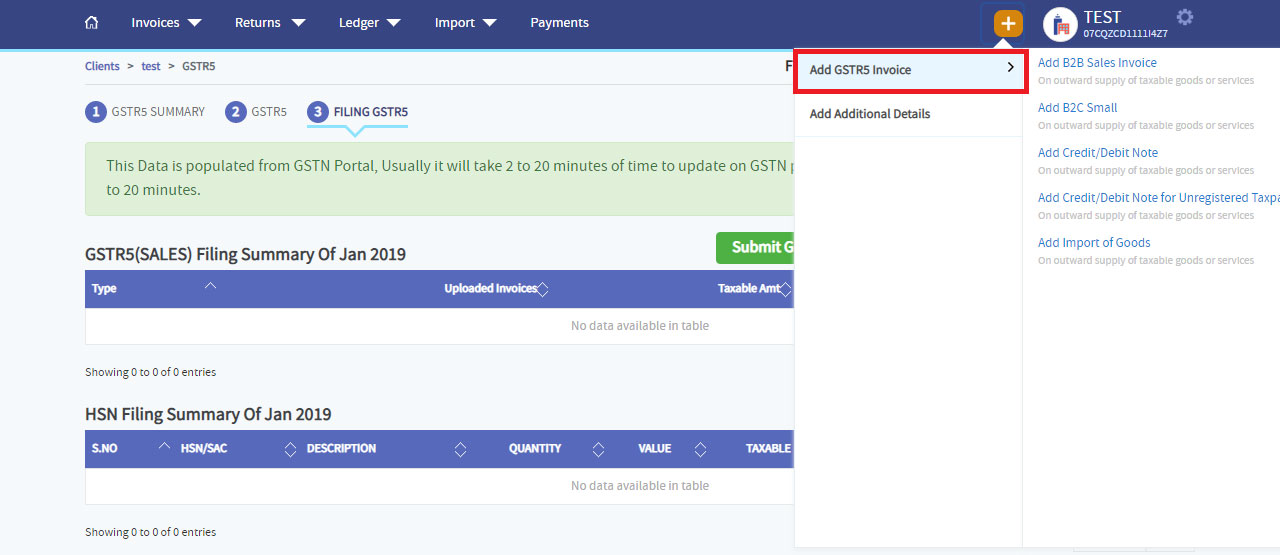

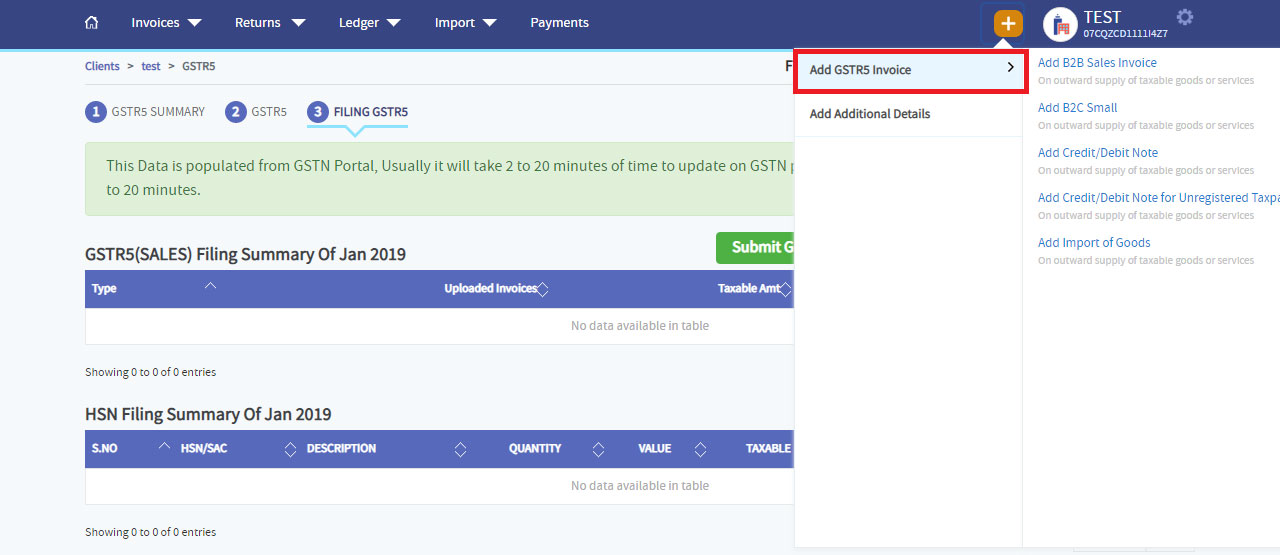

You will get a page with + on top of menu bar. you will get options to which you want to add invoice.

Step3 :

Go to GSTR5 invoice. you will get types of gstr5 invoice select by clicking on the invoice on right side of popup.

Step4 :

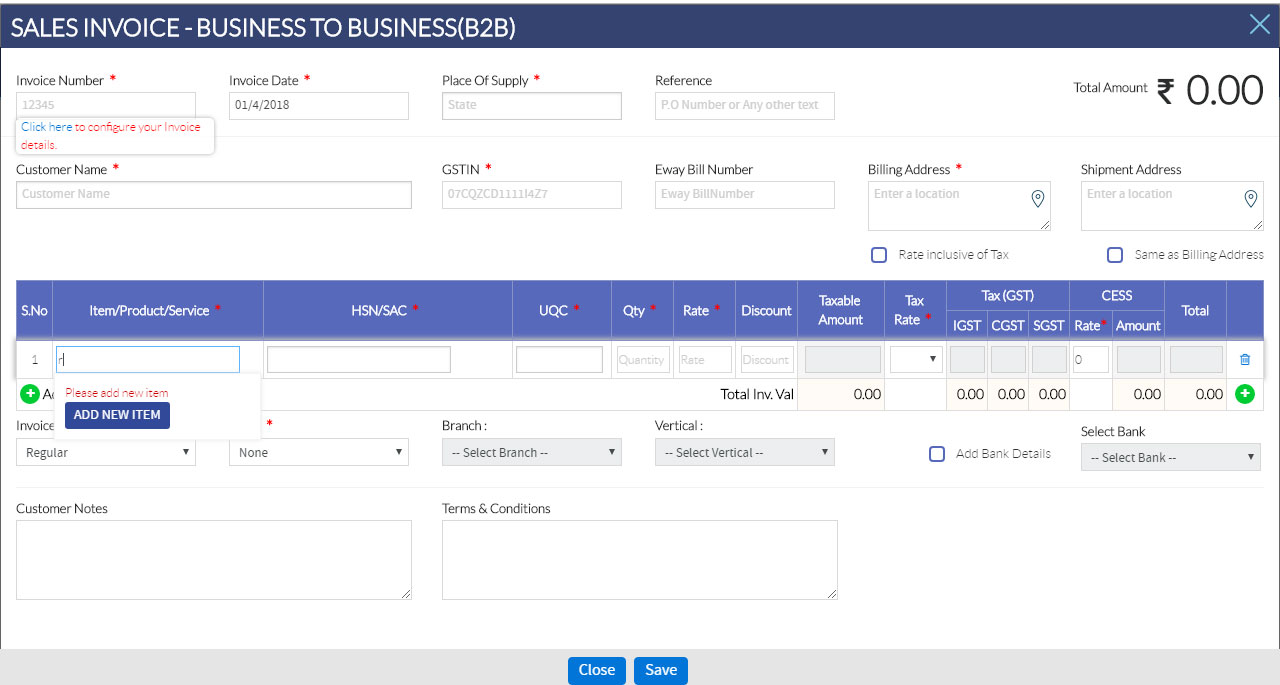

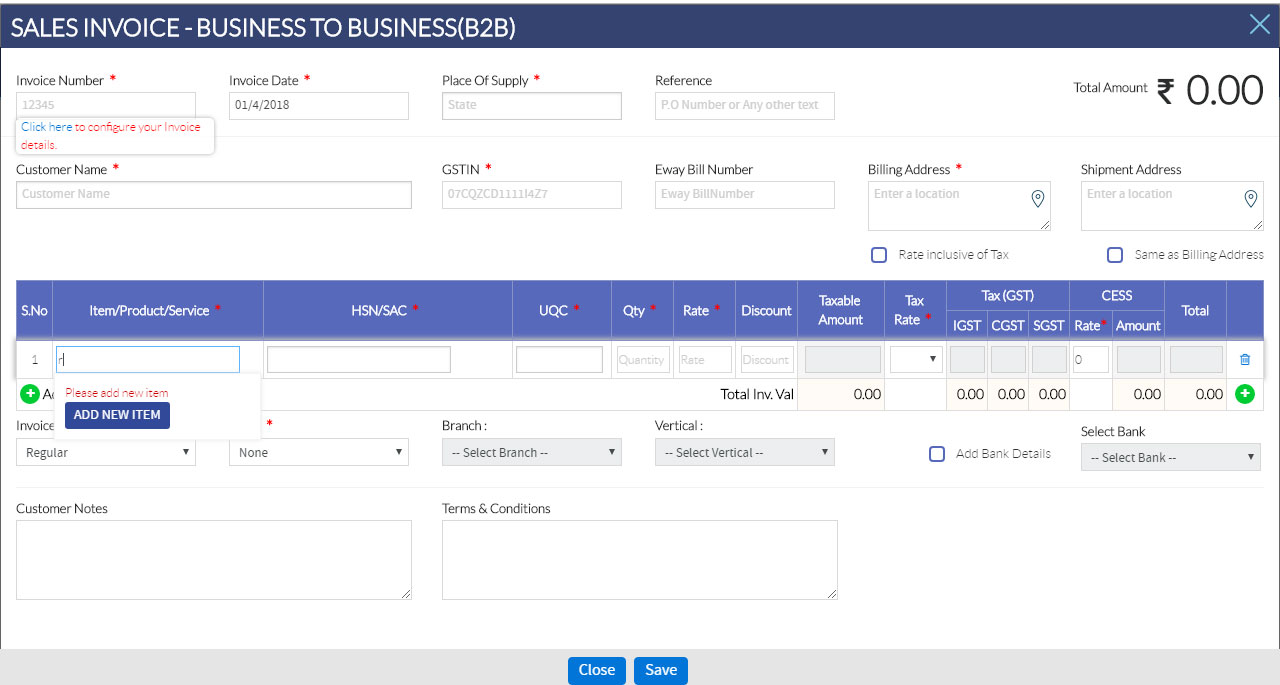

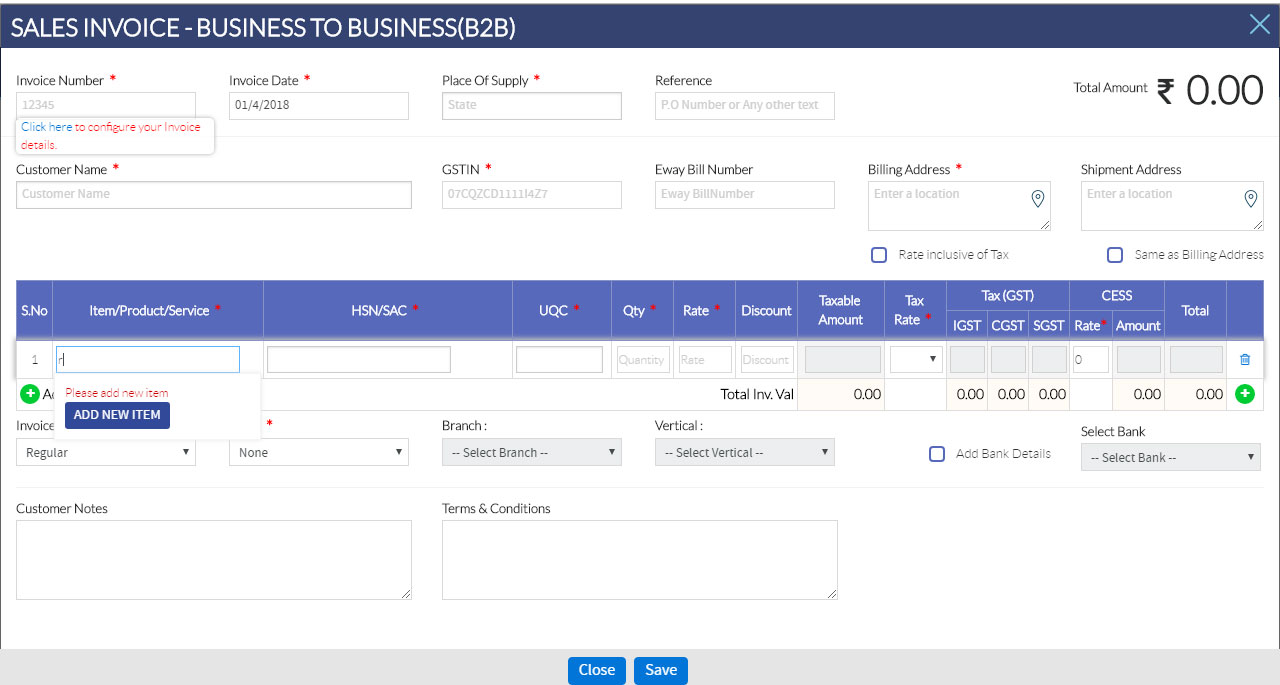

It will show a form, fill all the mandatory fields and click on save.

- Customer Name: Name of the customer.

- GSTIN Number: If the invoice is B2B give the GSTIN else If the invoice is B2C it is not needed.

- Invoice Number: is any number (or any other character) assigned to that bill by the issuing company so they can track it later.

- Invoice Date: just the date it was issued.

- Billing Address: Address of supply.

- Supply state: Select one radio button from following

-

-

- Intra state supply :If the state of supply and state of supplier are same then it is intra state supply. In intra state transaction, CGST & SGST will be charged. The CGST gets deposited with Central Government and SGST gets deposited with State Government.

- Inter state supply :If the state of supply and state of supplier are different then it is Inter state supply. In inter state transaction, IGST will be charged. IGST will be applicable on any supply of goods and services in both cases of import into India and export from India

- Is Billed & Shipped in the same Address: If the address is same then select yes else select no.

-

Add Item Details

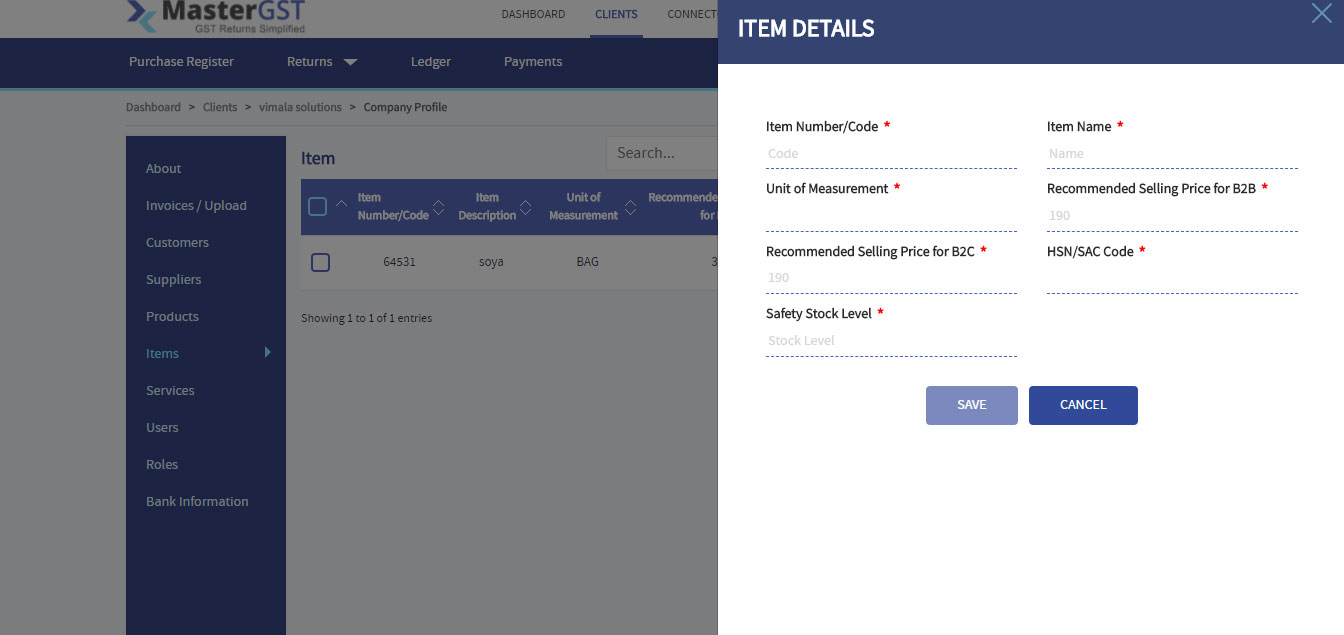

- Item Name: enter which item purchased ,if that is new item it will show add click on add item.

-

- Item number/code: Enter item code(must be more than 3 numbers)

- Item name: name of the item.

- Unit of Measurement : How the item will measure.

- Recommended Selling Price for B2B: Price for business to business.

- Recommended Selling Price for B2C: price for business to customer.

- HSN/SAC Code: which is a 6-digit uniform code developed by World Customs Organization (WCO) for goods and is universally accepted

- Safety Stock Level: How much stock is available.

- If the item is already there it will auto fill the Category, HSN, UQC, Rate of item.

- Quantity: Amount of quantity purchased. After entering quantity it will automatically fill the Taxable Value.

- If the supply is inter state, enter CGST,SGST

- CESS: To compensate the States for the loss in tax revenue, some states that are net exporter of goods and/or services are expected to experience a decrease in indirect tax revenue.

- Empty fields automatically fill. click on add item. You can see the details of added items. Can add any number of item in the same process.

- Check on Bank Details, enter valid bank details in fields.

Step7 :

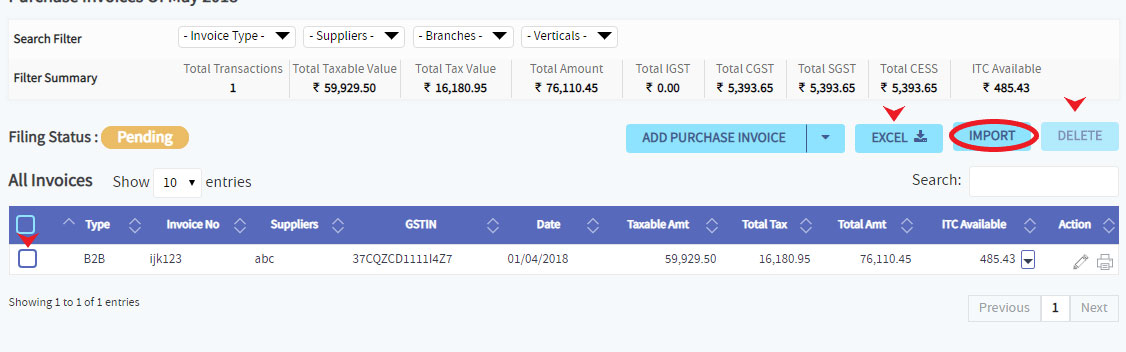

You can see the page with tabs contain the summary of invoice. you can print or edit the invoice by clicking on respective icon on action column. you also can import your invoices by clicking import button in the same tab.

Step8 :

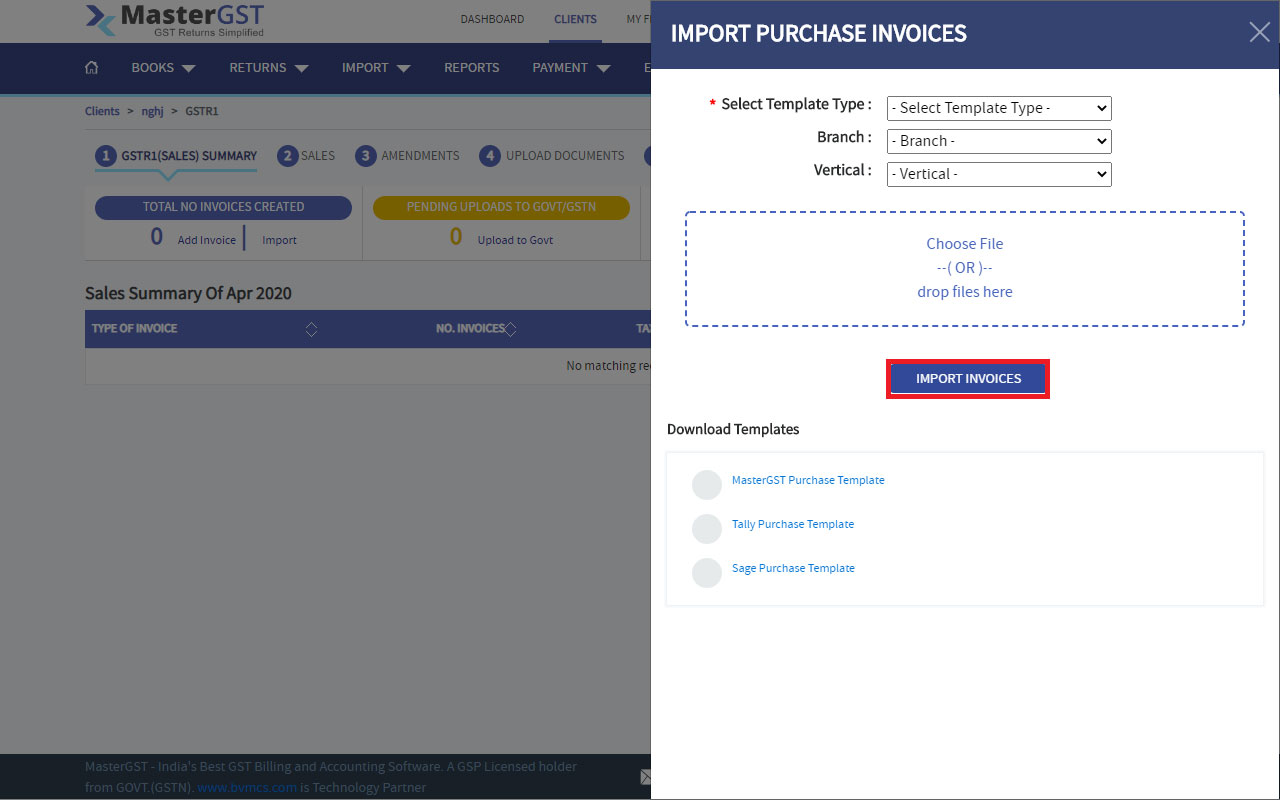

On clicking import button you will get a page as shown in below, In that choose the type of invoice and choose the file or drag and drop the file. Then click on Import Invoice, you will get if the upload is failed or successful.

Step10 :

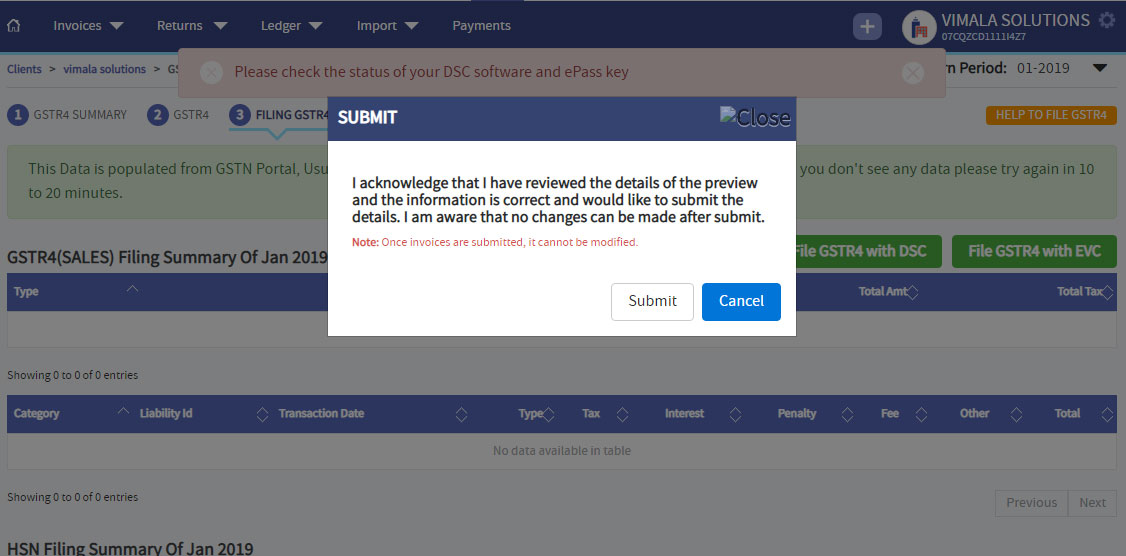

After selecting any invoice (at least one by checking) only delete button and upload button will be enabled. Click on upload button to to upload the invoices to GSTIN. To submit the data to GSTIN , go to filing GSTR5 tab you will automatically get the data ( if not wait for 2- 20 min ), check the data you have uploaded and click on submit GSTR5. You will get a pop up click on ok.

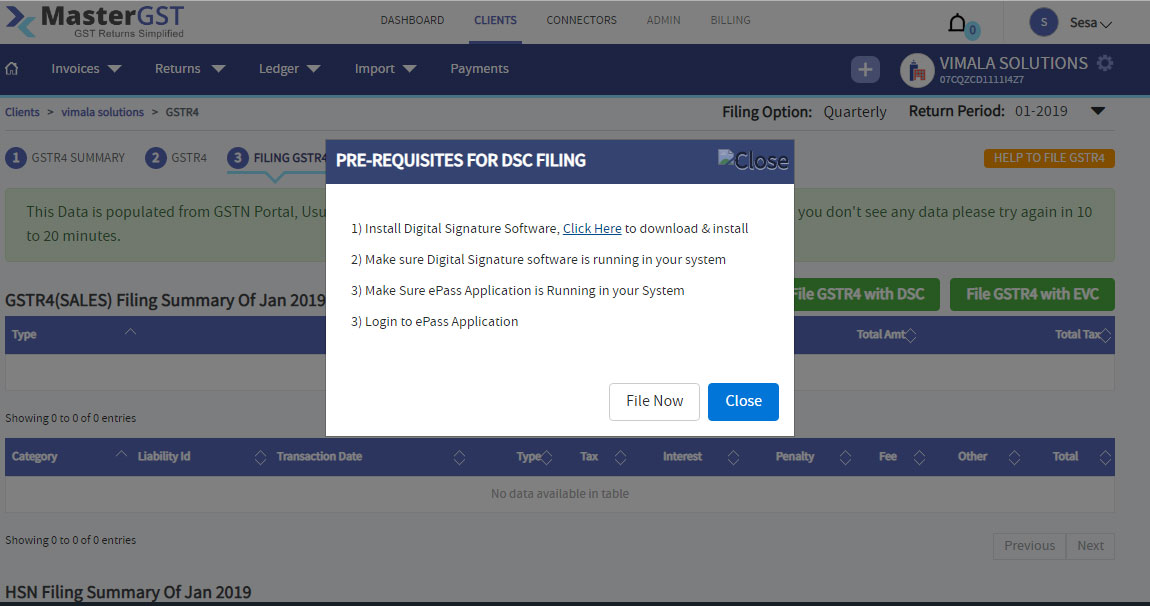

Step13 :

To file with EVC click on file GSTR5 with EVC button and you will get a pop up and enter the OTP you will to your registered mobile number and click on submit . The filing of GSTR5 completed .

Step14 :

To file with DSC click on file GSTR5 with DSC button and you will get a pop up check all the pre requisites for DSC filing . Click on file now .